Zurich shows support for New Generation event

Zurich Insurance Group has shown its support for ILC’s New Generation in Claims event by both sponsoring the occasion and contributing expert insight to the day’s agenda.

The event, which takes place on Wednesday 26 April at etc.venues, Manchester sees Zurich join Enterprise and Wiser Academy (headline) as sponsors to help shine a light on the need for both retaining talent and attracting new people within the insurance claims sector.

RSA to exit UK motor insurance market

RSA has announced it will exit the UK personal lines motor market.

The decision is one of a range of initiatives intended to make its UK and international business more sustainable.

RSA, a subsidiary of Intact Financial Corporation, currently represents about £120m of annual motor premium. It has further announced it will introduce MORE THAN direct motor customers to Swinton Insurance upon renewal.

Government launches ZEV consultation

The government has launched a consultation about plans to introduce a new ZEV mandate next year to drive the industry’s transition to net zero.

The proposed mandate will require 22% of new cars made to be zero emission models by 2024, with that rising to 80% in 2030 and 100% in 2035. For vans, the minimum target percentage is 10% in 2024, 70% by 2030 and 100% in 2035.

The government has also unveiled a robust package of measures to drive the shift to electric vehicles, which includes a further £381m to develop the public charging infrastructure.

New Generation in Claims Interview:

Toby Haggitt, Implementation Manager, Solera|Audatex

“With the motor industry’s shift to ‘smarter’ vehicles, and every new vehicle on the road now fitted with varying levels of ADAS, we’re very much at crossroads.”

Copart announces new Chamber of Commerce collaboration

Copart recently took part in a Chamber of Commerce networking event to discuss skills and training challenges and explore potential solutions to the skills gap.

This ‘Skills and Training: the Employers Voice’ event was held in the Digital Aviation Research and Technology Centre at Cranfield University, when cross-sector leaders shared insights around best practice, skills gaps, health and wellbeing, and employee retention.

Toyota updates injury analysis solution

Toyota has enhanced its vehicle safety research with further developments to Total Human Model for Safety (THUMS), its software programme for computer simulation and collision analysis.

The latest advances take into account changes in posture when drivers are using automated driving systems, with specific modelling for men, women and children and more accurate analysis of the geometry and properties of key body parts, including the pelvis, abdominal organs, spine and ribs.

Motor dominates GI complaints to Ombusdman

The Financial Ombudsman has received more than 55,250 complaints about motor insurance in the last five years.

This equates to nearly a third (30%) of all general insurance complaints referred, which is nearly double the percentage of the next product line.

Meanwhile, complaints about motor insurance products rose a worrying 49% from the last quarter of 2021 to the same period in 2022, with more than 3,800 complaints recorded.

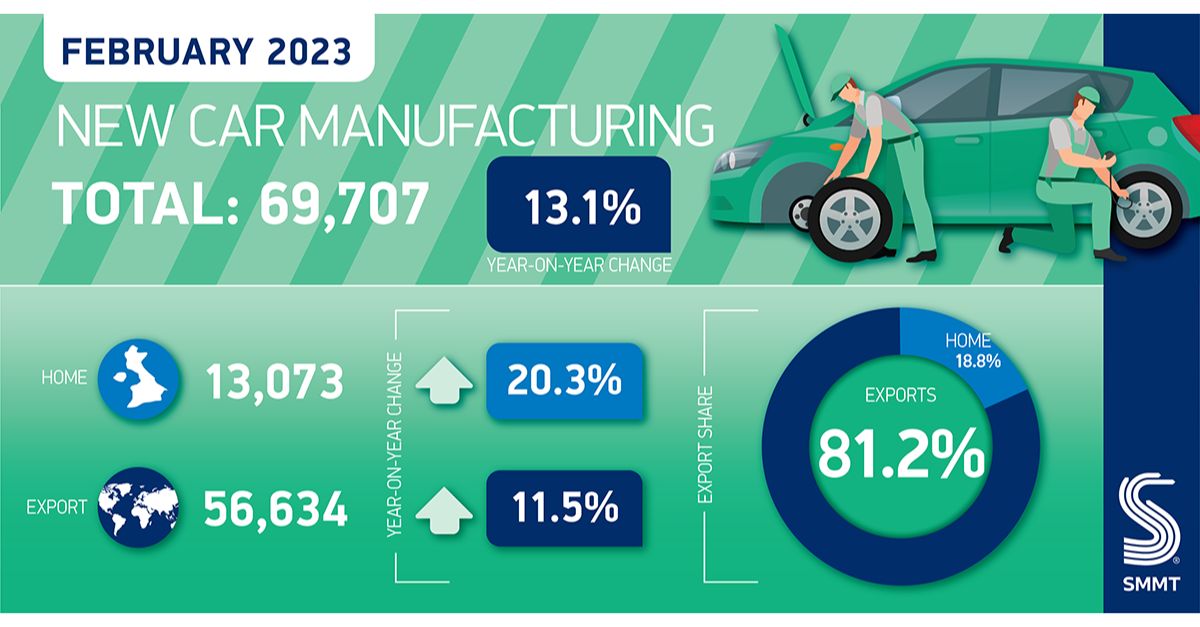

Car production rallies as supply constraints ease

The Society of Motor Manufacturers and Traders has announced that UK car production rose 13.1% in February to 69,707 units. Meanwhile, the transition to hybrid, plug-in hybrid and battery electric vehicles continued with combined volumes surging 72.2% from 15,905 to a total of 27,392 units and accounting for two in five (39.3%) cars produced in the month.

Against this however, commercial vehicle production fell by 21.6% in the second month of the year to 6,491 units.

e2e to unveil new reclaimed parts data

e2e Total Loss Vehicle Management has conducted in-depth research into the use of reclaimed parts by insurers and bodyshops.

The e2e Reclaimed Parts Report will be published on 4 April.

Green parts policy wins sentimental argument

Ageas’ Green Parts Programme helped AA Insurance Services policyholder Sue Sheldon continue to drive a car bought for her by her late husband after she was involved in a collision.

The use of green parts meant repair was economically viable, while using reclaimed parts also reduced the impact on the environment.

ADAS challenge ahead

Steve Gooding, Chief Executive of The RAC Foundation, has warned of a significant challenge in moving from assisted driving to full autonomy, suggesting the gap between the two is greater than many believe.

He said, “In reality, there’s a massive step-change between being a full-time passenger and a part-time driver.”

Suzuki introduces extended warranty

Suzuki GB has introduced a service-activated warranty to owners of cars and motorcycles aged up to seven years or 100,000 miles.

The free warranty will be offered to drivers of any vehicle that undergoes a service at the end of its three-year, 60,000-mile period, and will remain in place until the next renewal.

Enterprise & NFU take Gallup gongs

Enterprise Holdings and NFU Mutual have received Gallup Exceptional Workplace Awards for 2023.

The awards recognise commitment to employee engagement and flexibility around hybrid working.

It is the eighth time NFU have picked up the award.

Vertu expands repair capacity

Vertu Motors has enhanced its repair capacity by increasing its mobile alloy wheel repair fleet to 32.

Neil Hall, Group Bodyshop and Cosmetic Repair Director, said, “We are constantly evolving and listening to our colleagues to improve. This [van] is version four so a big thank you to the Smartfix team and On Board Power.”

NBRA director takes the industry to young people

NBRA Executive Director Chris Weeks promoted the automotive repair industry to more than 40 pupils at a school in Northampton this week, reporting that around 90% subsequently signed up as AutoRaise cadets with around a quarter expressing in interest in an apprenticeship.

Autoglass partners School of Thought

Autoglass has announced that 14 colleagues have signed up to become STEM ambassadors, in partnership with School of Thought.

As ambassadors, they will promote STEM subjects and potential career pathways to young people at schools, colleges and in the wider community.

Audit treble

Three repair sites have recently celebrated successful Kitemark BS10125 audits. They are Steer Automotive Group repair centres Steer Stockton and Steer Washington, as well as Balgores Motor Group Witham.

The BS 10125 standard for vehicle repair is recognised by insurers, manufacturers and work providers.

Gen Z divide revealed

New research from Deloitte has revealed a disconnect between Generation Z employees and their employers.

Its research found that Gen Z value mental health and empathy more than their bosses do, and also believe both have a significant impact on engagement and work quality.

Charity match held in memory of friend and colleague

Plunky’s All-Stars 2023 charity football match, which will take place at Peterborough United’s ground on 1 June, is nearly a quarter of the way to its fundraising target of £20,000.

That match is raising funds for The Norfolk Hospice Tapping House and will be played in memory of Mike Yorke, who passed away last December after a long battle with a brain tumour.

Mike played in every single Plunky’s All Stas game apart from the 2022 match.

People

David Palmer has been named Preparation and Aftersales Director at Cazoo.