EV pulse headlines

- 2024 new vehicle registrations – BMW challenges Tesla for EV market dominance

- Average EV repair costs down 1.6% year on year

- EV repair cycle times continue to fall from 2022 peak

Introduction

In the early days of the electric vehicle (EV) industry, the lack of comprehensive data posed significant challenges for fleets and insurers, making risk assessment and informed decision-making difficult. As the EV market has grown, we now have a richer level of data on EVs, and the costs associated with maintaining and repairing them.

To provide valuable insights into this evolving market, Activate Group, the accident management specialist, is launching a quarterly EV report, utilising data from Gecko Risk. This report aims to offer comprehensive and up-to-date information on the latest trends and developments in EV repair, from average repair costs to cycle times.

Electric Vehicle Market

There are more than 1.1 million EVs on UK roads, and 55% of these have been registered in the last two years.

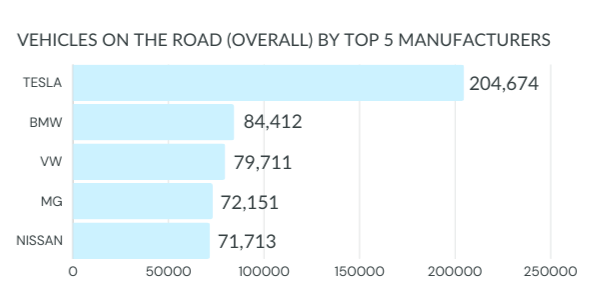

This is a sector of the UK car parc that’s growing fast. Initially, this growth was driven by specialist manufacturers and early adopters like Tesla and Nissan. The Tesla model 3 is the UK’s most popular EV of all time, with 104,781 registered on UK roads.

Top 5 EV manufacturers overall

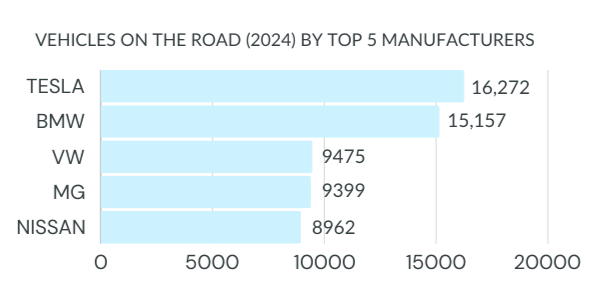

More recently, high-end marques like BMW, Mercedes and Audi have been building market share, challenging Tesla’s dominance in the EV market.

Top 5 EV manufacturers 2024

James Fisher, CEO of Gecko Risk commented: “To date we have seen battery electric vehicle adoption being predominantly driven by fleets and those who can afford the luxury of owning high value vehicles. At Gecko we are interested to see how the demographic of EV drivers changes over the next few years with less expensive models due to hit the road from Chinese manufacturers like BYD and Great Wall Motors. With younger drivers behind the wheel of BEVs the risk in this subsector will continue to evolve and will require up to date analysis.”

EV Repair Cost Trends

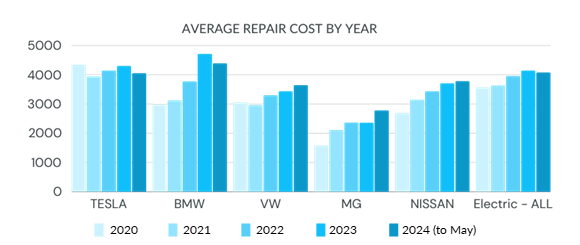

Figures for the first five months of 2024 reveal that average EV repair costs have come down from their 2023 peak.

This data bucks a five-year trend that has seen the average EV repair cost rise steadily from £3,499 in 2019 to £4,149 in 2023.

To date, the average EV repair cost for 2024 is £4,084, down 1.6% when compared to 2023.

The reduction in EV repair costs is somewhat at odds with the market overall, as average repair costs for ICE vehicles continued to rise slightly in the first months of the year.

Adrian Furness, Managing Director of Motor Repair Network, Activate Group’s insurance division, said: “There has been a high level of investment in EV capability across the industry, creating repair availability. With increased capacity and a reduction in repair volume across all vehicle types, we may see more evidence of average repair costs leveling out or reducing over the coming months.”

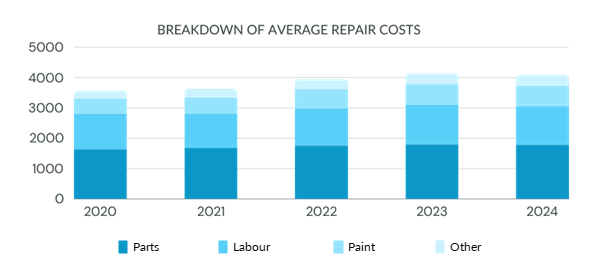

Average EV repair cost breakdown

When we break down the cost of repairs, it’s clear that parts costs consistently represent the highest outlay.

Data from the last five years reveals that parts costs account for 44% of overall EV repair costs on average.

Interestingly, Tesla repair data does not follow this trend. Here, labour costs are consistently higher, accounting for 42% of the repair cost in comparison to 34% for parts.

Mark Hobson, Operations Manager for Activate Parts, Activate Group’s wholesale parts division, commented: “In general, EVs are packed with technology and made of lightweight materials that are more challenging to repair than traditional ICE vehicles. This, coupled with low availability of green and aftermarket EV parts, explains why parts account for a high proportion of the average EV repair cost.

“Tesla stands out because repairs are usually completed by main dealers and manufacturer approved repairers, where labour costs are significantly higher. In addition, Tesla does not readily offer parts discounts which makes it more economical for bodyshops to repair rather than replace a part if it’s safe to do so.”

EV Repair Times

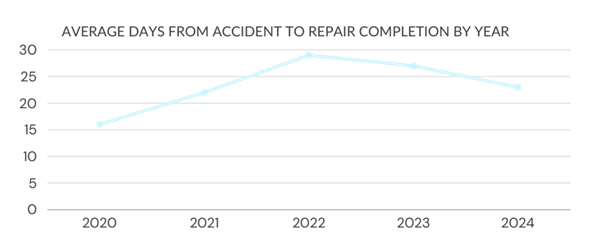

Looking at the full cycle time from accident date to repair completion, we see that EV repair cycle times have fallen significantly over the last two years.

Gecko data reveals that the cycle time peaked in 2022 at 29 days and is tracking at an average of 23 days so far in 2024.

Adrian said: “This change is in line with the wider market, where there has been significant improvement in repair times across all vehicle types.

“This has been driven by investment in new, state-of-the-art repair capacity as found in our own Activate Repair sites. In addition, we are seeing higher excesses and an increased rate of write-offs, which have a knock-on effect on repair availability.”

Conclusion

The electric vehicle market in the UK is undergoing rapid growth, supported by investment in training and equipment across the vehicle repair industry.

Increased repair capacity and EV capability, coupled with a reduction in repair volume across all vehicle types is helping to stabilise repair costs and bring down cycle times.

With the increasing availability of comprehensive data, fleets and insurers can now make more informed decisions, enhancing their ability to manage risks and costs effectively.

Activate Group’s new quarterly EV report, powered by Gecko Risk data, aims to provide crucial insights and trends, supporting stakeholders in navigating this evolving landscape. As the EV sector continues to expand, staying informed will be key to leveraging the opportunities it presents.