Activate Group’s quarterly electric vehicle (EV) report has revealed that EV repair costs have fallen six per cent across the board in the last quarter, with parts costs down eight per cent.

The report draws on Gecko Risk data to provide updates on EV adoption and repair cost trends, exclusively focussing on battery EVs.

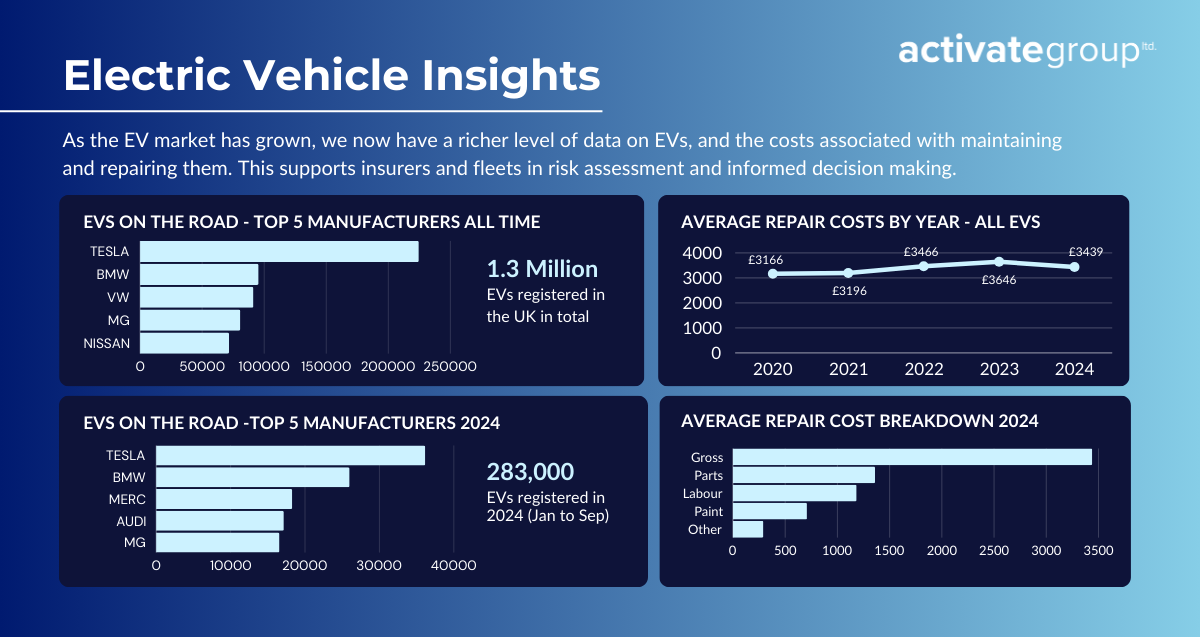

It found that as of September, over 280,000 battery EVs have been registered this year, with high-end brands continuing to lead the market. Tesla holds the top position, while BMW, Mercedes, and Audi have gained significant market share. MG remains in the top five, however Volkswagen, has shown strong quarter three growth thanks to the popularity of its ID range.

James Fisher, CEO of Gecko Risk, said, “Prestige makes dominate EV sales this year, perhaps due to purchasing an EV being seen more as luxury than a necessity. At Gecko we are very interested to see how cheaper makes and models coming out of China impact EV take up, with a more environmentally conscious younger generation soon being able to afford to get behind the wheel of an EV. Also, will ongoing cheapening second-hand purchasing opportunities begin to attract a wider audience?”

EV repair cost trends

Year to date, the trend for reduced EV repair costs continues, with average costs down six per cent year-on-year. All of 2024’s highest selling manufacturers have seen a year-on-year reduction in repair costs, with BMW recording the largest drop at 11%.

Adrian Furness, Managing Director, Activate Group Insurance Services, said, “With major manufacturers now offering a strong lineup of electric vehicles to rival their internal combustion engine (ICE) models, competition in the EV market is increasing. This growth is not only driving down costs but also advancing knowledge within the repair industry.

“In recent years, capacity issues meant repair sites had little incentive to invest in the technology and training needed for EV repairs. However, with repair volumes across the market dropping by around 10% over the past year and EV numbers on the rise, repairers are now investing in the skills and equipment necessary to meet this growing demand.”

EV repair cost breakdown

Parts remain the largest component of EV repair costs, though labour is the highest cost for Tesla and MG repairs. Year-on-year, parts costs have fallen by eight per cent, while labour has decreased by four per cent, offset slightly by an eight per cent increase in paint costs.

Adrian added, “Average repair costs are evolving as EVs become more mainstream in the UK. While repair costs in the wider market continue to rise, we see a downward trend for EVs, particularly in parts costs—an indication that EVs are gradually moving towards cost parity with traditional fuel vehicles.”

Conclusion

The EV market continues its rapid evolution, with high-end brands challenging Tesla’s dominance and overall repair costs trending downward as EVs gain traction on UK roads. Increased competition is driving cost efficiency and pushing the repair industry to expand its EV capabilities, addressing both capacity and expertise gaps. As parts and labour costs decrease, EV repairs are becoming more affordable.