ARC360 hosted its final webinar of 2021 this week, when panellists examined the ever-evolving data and its impact on the automotive incident repair sector.

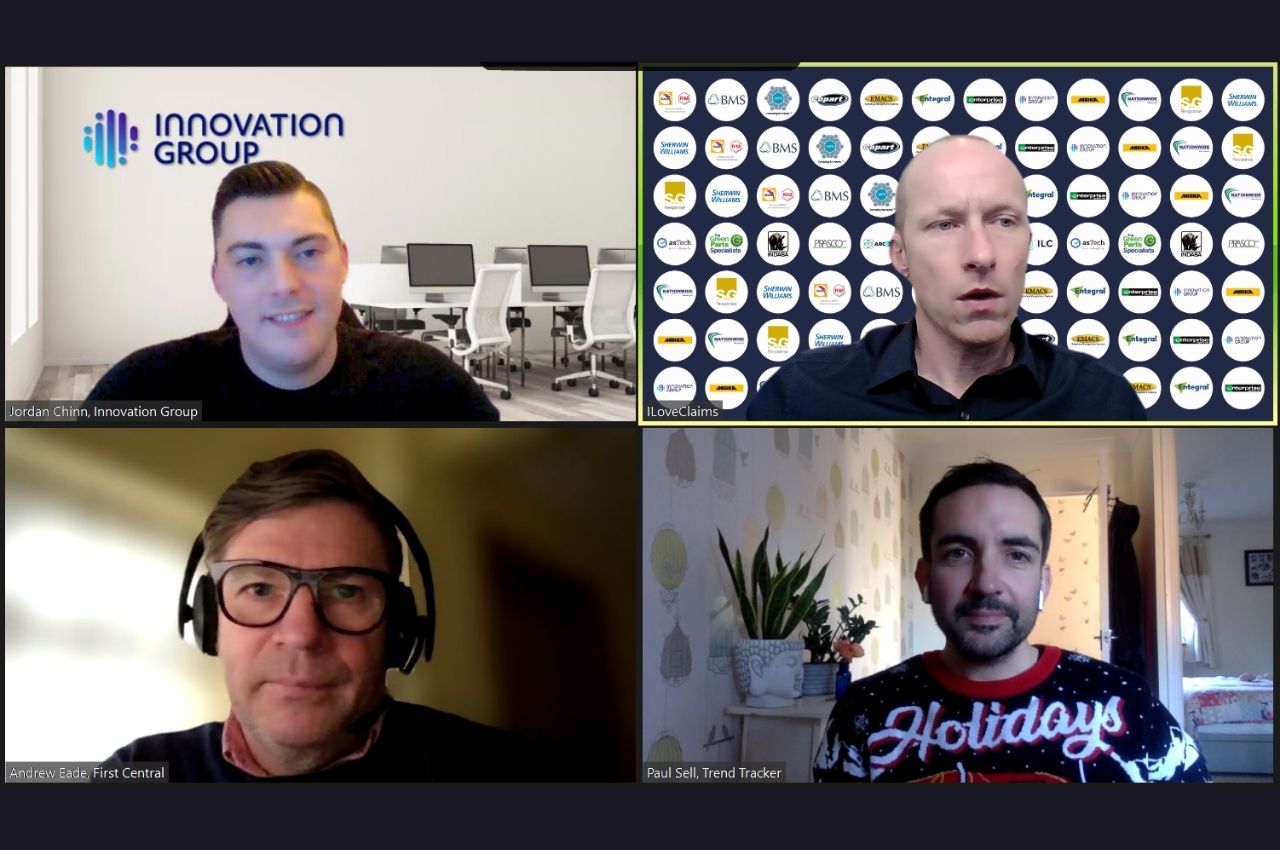

Taking part in the ‘The Data Jigsaw 2’ were Jordan Chinn, Network Manager, Innovation Group; Andrew Eade, Head of AD Strategy and Development, First Central; and Paul Sell, Associate Director, Trend Tracker.

The first topic of concern was volumes, and while Jordan said Innovation Group is reporting 95-98% claims volumes on pre-pandemic levels and Andrew said First Central was seeing about 92% of claims frequency, both agreed that the impact of the government’s recent decision to initiate Plan B in the battle to calm the spread of the Omicron variant of Covid-19 has yet to materialise.

Paul suggested any affects would not be felt until the new year.

He said, “Normally severe weather in winter means increased frequency, but that’s not likely this year with reduced travel as a result of the restrictions. So we aren’t going to see the volumes we’d expect in a typical January and February. They may drop back into the 80%s and then pick up again from March.”

Relief

However, the absence of the traditional uptick in work may actually come as a relief to the sector, which is struggling to process the jobs it already has.

Jordan said a lack of staff and parts is having a negative effect on capacity, although of greater concern now is the lack of mobility options. With car production severely dented by the pandemic, fewer vehicles have come to market, which in turn has placed a substantial strain on the availability of courtesy cars.

Andrew agreed, saying, “The issues stopping new car production aren’t going away and we’re now in a situation where the number of new vehicles being produced isn’t enough to satisfy demand. We need to work differently because supplying mobility will be a challenge going forward.”

One option put forward by Paul was asking customers, many of whom are now working from home, whether they would be prepared to go without a replacement vehicle while their car is being repaired.

“It’s an option,” said Jordan, who emphasised the need for more collaboration throughout the supply chain to overcome current challenges. “We need to understand the needs of the customer.”

Costs

Meanwhile, the sector is also facing the same difficult conditions that are affecting all industries. Costs across the board are going up; inflation is now at a 10-year high and will continue to increase well into next year, energy and gas prices are rising, while parts and labour are also becoming more expensive to procure.

On top of all this, the repair sector must adapt to the continued change taking place within the car parc. In 2019 traditional internal combustion engines made up 92% of new registrations. Last year that proportion dipped to 64%, with battery-powered vehicles comprising 36% of new sales, and by 2023 Paul predicts that ratio to have completely reversed, with EVs accounting for almost two thirds of sales.

He said, “Everything in the macro environment is changing. Nothing is stable. It is exciting place to be but also very challenging.”

Addressing the rise of EVs and a wide range of other sustainability questions, ARC360 will return with its next webinARC on 26 January 2022.

ARC360 would like to thank its Corporate Partners BASF, BMS, CAPS, Copart, Emacs, Entegral, Enterprise Rent-A-Car, Innovation Group, Mirka, Nationwide Vehicle Recovery Assistance, S&G Response, and Sherwin Williams as well as Partners asTech, The Green Parts Specialist, Indasa and Prasco.