Motor Claims

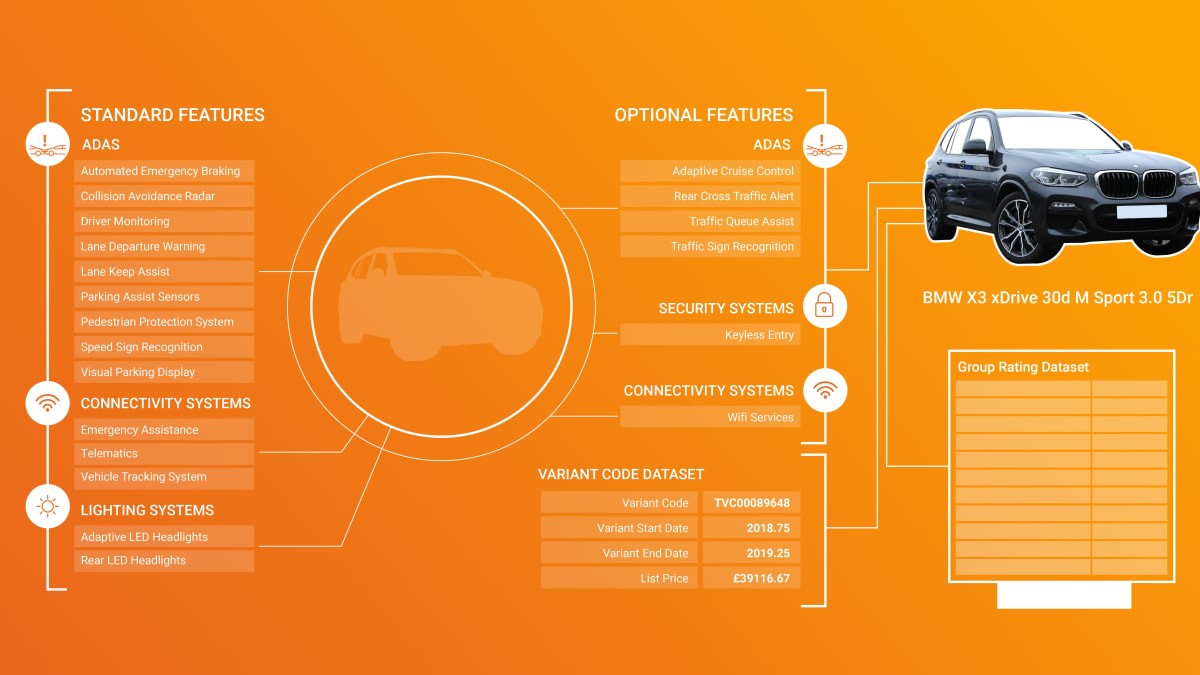

Verisk adopts Thatcham Research code

Verisk is incorporating Thatcham Research’s Variant Code to enhance it motor insurance solutions.

The Variant Code provides updated information on features included within models, including Advanced Driver Assistance Systems (ADAS), expensive headlights, and keyless and connectivity systems.

Dan Payne, Chief Digital Officer at Thatcham Research said: “This is about accurate risk assessment at a uniquely granular level. Variant Code offers a competitive advantage, empowering Verisk’s insurer customers to make more informed and intelligent decisions, and price according to the features present on a particular model variant. This is fundamental as vehicles evolve and technologies that were once the preserve of high-end models are increasingly made available at entry level.”

Copart goes live with two new sales sites

Copart UK has launched two new websites to help customers sell their cars instantly.

Customer-facing sites CashForCars.co.uk and Cash-For-Cars.ie have gone live to provide a free, online quote within 60 seconds, a free nationwide collection service, and fast payment upon receipt of the vehicle.

Any vehicle in any condition will be accepted, while customers also have the option of dropping off their vehicles to dedicated areas based at Copart UK’s 15 nationwide Operation Centres, and in Ireland at Copart’s Head Office or one of its sub-lot.

GT Motive announces new supply partner

Claims estimating and management solutions provider GT Motive has appointed Quantum Technical as sole supplier in the UK.

The announcement comes after months of development and research.

David Punter, founder and CEO of Quantum Technical, said, “It is great to support a forward-thinking company who address the market from a user perspective, and have demonstrated their flexibility with customers and partners, to offer a real alternative to the market.”

LV=BR introduces EV roadside assistance

LV=Britannia Rescue (LV= BR) has launched a new comprehensive electric car service to customers who break down in London.

Introduced in partnership with LAR Traffic Services, the service will see a fully qualified technician with the tools and diagnostic equipment necessary for repairing electric cars at the roadside attend to customers.

The service will be carried out in an electric van equipped with an electric car recharge unit, providing a fully end-to-end electric breakdown service.

Insurers respond to CCPC investigation

Six leading insurance companies have agreed to reform their internal competition law compliance programmes after an investigation by the Competition and Consumer Protection Commission (CCPC) in Ireland.

The investigation focused on anti-competitive practices in the provision of motor insurance, and although AIG Europe, Allianz, AXA Insurance, Aviva Insurance Ireland, FBD Insurance and AA Ireland all deny any breaches, each has made legal commitments to provide mechanisms for internal monitoring and whistleblowing, independent oversight and regular competition law training.

A seventh company, Brokers Ireland, has not agreed to the terms.

ADAS uncertainty putting drivers at risk

Faulty ADAS systems could be putting millions of drivers and other road users at risk.

Research from Autoglass found that 80% of drivers think ADAS systems that have been incorrectly repaired or recalibrated will warn them of the fault. However, ADAS technologies currently do not have the capability to alert the driver if they are not correctly aligned.

ADAS sensors need to be recalibrated correctly after most repairs, includes a windscreen replacement, but less than half (48%) of UK drivers realise this is the case.

Used car prices continue upward trajectory

Used car prices on the Auto Trader platform rose for the 66th week in a row this month.

It reported a 15% year-on-year rise in the week starting 9 August, with consumer demand and disruption in the supply of new vehicles contributing to the continues price increases.

It also found that used cars sell in 26 days on average, which is 10% quicker than when the forecourts opened after lockdown in April.

Meanwhile, its own research found that 46% of new car buyers would not be prepared to wait for more than a month for a new purchase while 74% would consider a used car instead if the time-lag on a new vehicle was too long.

Home claims

Flood losses to exceed €5bn

Catastrophic modelling company RMS has estimated the insured losses from the floods in Western and Central Europe in the middle of July at between €5bn and €6.5bn.

The US-based company reconstructed a flood hazard footprint that covers the worst affected areas to calculate these losses, finding that Germany is the dominant contributor of loss with about 70% of the total loss, followed by Belgium with about 25% of the loss.

The loss estimate includes insured property and business interruption loss to residential, commercial, industrial, automobile, and infrastructure lines.

Guidewire acquires risk insight specialist

Software specialist Guidewire has acquired HazardHub, a provider of API-driven property risk insights to the property and casualty insurance industry.

HazardHub collects and analyses data to provide a comprehensive catalogue of risks, while its API provides risk scores and supports the underlying information for any US property.

Mike Rosenbaum, CEO, Guideware Software, said, “Underwriters, agents, and claims adjusters will power smarter decisions with risk insights embedded directly into core workflows. Embedding HazardHub’s comprehensive property risk data service into Guidewire’s industry-leading platform will drive tremendous value for our customers and the P&C insurance industry.”

Claims tech

London insurers create new digital roles

AEGIS London has named its first chief technology officer as it accelerates its digital transformation.

Mark Degenaar has been appointed to support the development of the business’s digital and technology strategy. He joins from Insurance Business Applications, and has held a range of senior technology roles within the insurance sector and other markets.

Meanwhile, Ki, the fully digital and algorithmically-driven Lloyd’s syndicate launched by Brit and Google Cloud, has also created a new chief technology officer position, appointing Richard Hodgson to lead its technology strategy and execution.

Tysers launches Tconnect

London-based insurance broker Tysers has launched Tconnect – a cross-functional, cloud-based platform designed to consolidate processes and automate the end-to-end lifecycle of a policy.

The launch represents a notable milestone in the company’s digital transformation and modernisation of its existing IT infrastructure, which is intended to improve operational efficiencies and streamline claims workflows.

Steve Jolley, CIO, said, “Tconnect is the realisation of a year-long programme of process development and a major step forward in connecting systems, clients and markets to digital trading platforms. Using API technology to eliminate re-keying, RPA technology to automate processes and being fully cloud based, Tconnect is available anytime, anywhere, on any device.”

DXC introduces new insurance platform

UK-based tech company DXC Technology has partnered with next-generation global specialty insurer Mosaic Insurance to launch an insurance technology platform that it claims increases the speed at which specialty insurance is sold, underwritten and serviced.

The new platform automates interactions throughout the risk life cycle with: machine-learning algorithms and natural-language processing that enhance underwriting in Mosaic’s highly technical product lines; blockchain infrastructure that provides transparent and instantaneous sharing of data across the platform among brokers, syndicated capital partners, reinsurers and regulators; and data transparency, open interfaces, robotics and AI that cut costs and streamline processes.

New tech altering risk profiles

Technology is changing the way companies measure and manage risk, according to a new report published by Willis Tower Watson.

It found that Covid-19 has accelerated the shift towards digitalisation, and the companies which do well going forward will be those who ‘develop resilient workplace cultures, careful risk management and detailed business continuity plans.’

A key part of this will managing a hybrid workforce, with remote working introducing new risks to both the individual and the company.

Market news

Goldman Sachs expands European footprint

Goldman Sachs will buy Dutch insurer NN Group’s asset management arm for around €1.7bn.

The acquisition is the largest by the Wall Street firm since David Solomon became chief executive in 2018 and is part of a longer-term strategy to make the bank’s revenue stream less reliant on earnings from trading and advising on deals.

Goldman Sachs has said that all NNIP’s 900 employees will join the company as part of the deal, while the Netherlands will now become a significant location in its European business.

Courts green-light landmark class action case

A London court has approved a £10bn-plus class action against Mastercard that could entitle 46 million British adults £300 pounds each.

Former chief ombudsman of the Financial Ombudsman Service, Walter Merricks, claimed Mastercard charged unlawful fees to retailers and businesses processing transactions. Now the Competition Appeal Tribunal has certified the case as a collective action, which could see Mastercard ordered to pay compensation to more than 46 million shoppers.

Merricks said, “Mastercard has thrown everything at trying to prevent this claim going forward, but today its efforts have failed. The tribunal’s ruling heralds the start of an era of consumer-focused class actions which will help to hold big business to account in areas that really matter.”

BI claims top 21,000

The Financial Conduct Authority (FCA) has revealed that business interruption claims are approaching £1bn, but 15,400 companies are still waiting for payouts.

FCA figures show that insurance companies have paid out more than £968m in BI claims – £636.7m in final settlements and £331.2m in initial payments.

However, the final figure is expected to rise substantially with 38% of the 41,666 policyholders who have been told they are entitled to insurance payouts still waiting to receive any money.

New starts

LV= General Insurance has appointed Matt Crabtree as Head of Financial Crime Strategy. He will be responsible for overseeing the company’s Intelligence Team, Special Investigations, and Linked and Organised Crime areas.

Meanwhile, SimCorp has announced that Christian Kromann will succeed Klaus Holse as Chief Executive Officer from 2 September, and Wills Towers Watson has selected Carl Hess as the company’s new President and next Chief Executive Officer.

Elsewhere, Catherine Cooper has been named director of business development, Asia, for global provider of tech-enabled risk, benefits and business solutions, Sedgewick, global reinsurance placement platform Supercede has hired Aydin Betez to lead the development of its cloud-based digital ecosystem, and Partners& has appointed Ross Dingwall as Managing Partner (Scotland), charged with expanding the company’s footprint in the North of England and Scotland.