To understand the value of business development in the automotive industry, imagine how an organisation would have been left behind by its competitors if it had not moved on in the past five years in terms of products, processes, services and skills.

Perhaps even more tellingly, imagine the irrelevance of that same business if it fails to move on in the next five years.

But what exactly is business development and how is it achieved? It is not simply about growth, although growth is an almost inevitable consequence. Instead, developing your business can typically take place in four ways:

- Organically

- Strategically

- Internally

- Partnerships

Organic

Organic development is as straightforward as it sounds – it describes business progression without radical change, but simply through steady improvements to what it already does. As a result of better service and efficiencies, its customer base grows, its market penetration, and its profit margins.

One obvious area where this is taking shape is in the adoption of more technology to streamline the claims journey.

Solera is a market-leader in automotive tech and Neil Garrett, Sales Director for Solera UK, South Africa & Nordics, believes that the one technology on the brink of revolutionising the sector is artificial intelligence (AI).

Its own research has recently revealed the growing appetite among bodyshops for AI solutions, and he believes wider adoption cannot fail to result in significant business development.

He said, “We can see continued digitalisation of the claims process from FNOL through to settlement in all our global markets and there is still strong demand for this. The use of AI to ‘assist the expert’ will increase across the claim’s workflow, but in the short term, this will not be in a very visible way to the end consumer.”

He continued, “The introduction of AI at various touchpoints may be small at first, but as people grow to trust the AI and understand how a decision has been made, this will invariably ramp up.”

Strategic

Strategic growth is slightly different as it means not just doing better, but doing more. This can be achieved through a diversification of services to access a wider customer base, or the development of new products.

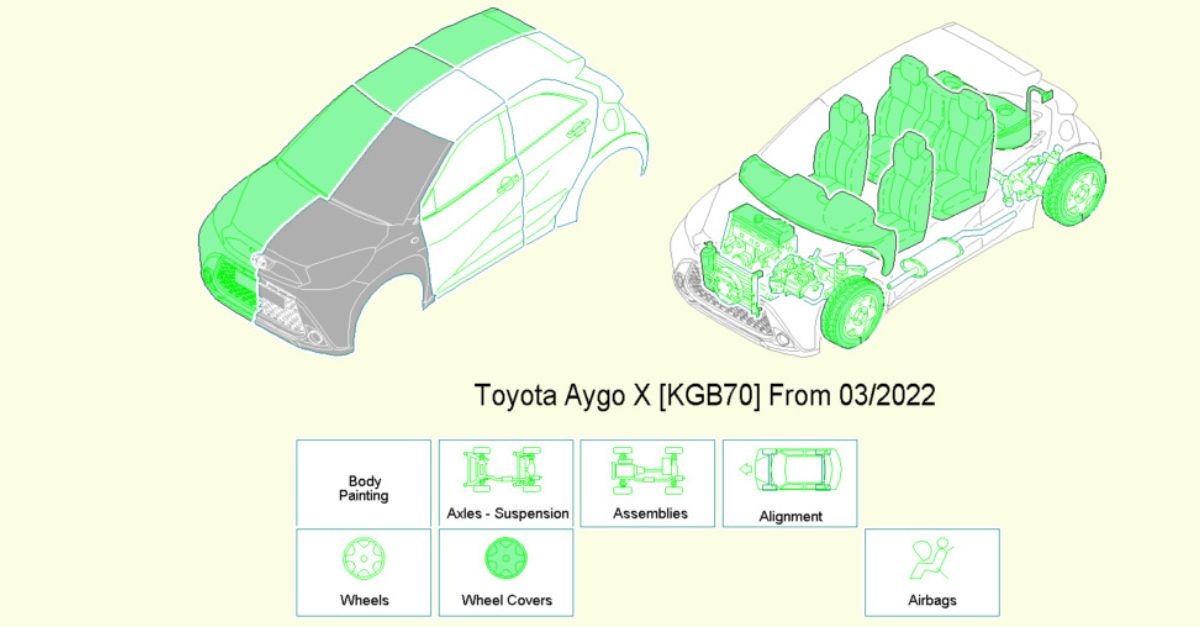

For many bodyshops today this means introducing electric vehicle repair capabilities or investing in ADAS diagnostic and calibrations equipment. However, as both EVs and ADAS become mainstream, this could be less about development and more about moving forward just to stay still.

In terms of new products, the supply chain is awash with innovation as organisations rush to develop and deliver new cutting-edge solutions. Integration and data transfer sit at the centre of this, and here too Solera is setting the pace.

Neil said, “As a tech company and the market leader, I often feel business development has a completely different meaning for us compared to others in the market. For us, it is founded on innovation and new technologies.”

But it is far from alone. A key rival in the estimating arena, GT Motive, has recently announced new developments around its imaging services that enables all relevant data to be viewed in a single location, while CAPS has unveiled a new and improved data platform.

Meanwhile, in the last month Repairify has announced it will launch a new technical training programme next year – the Repairify Institute – that introduces adoptive learning to the market.

All these are examples of businesses developing new solutions or services to broaden their appeal.

Internal development

Internal development focuses more on culture and engagement, and in light of the acute skills crisis afflicting the sector, ensuring your workforce is trained, motivated and resilient had never been more fundamental.

Even the best strategies are doomed to fail without the workforce to implement them, but the latest data and predictions around the skills gap are alarming.

The number of job vacancies in the automotive sector rose by 40% in the first three months of 2022 and the trend has continued with latest figures from the Institute of the Motor Industry reporting a black hole of 20,000 vacancies – that means for every 100 jobs in the industry 3.8 are currently unfilled.

Its latest Automotive Job Postings Briefing also found that job postings for vehicle technicians have risen by 70% since 2019. Adverts for tyre, exhaust and windscreen fitters have shot up by 21.3% in the same period while vehicle and parts sales listings are up 45%.

But if recruitment is a challenge, then developing your existing workforce is equally critical and, alongside technical skills, encouraging a growth mindset among employees – defined by accountability, common purpose and continuous learning – is fundamental to supporting business development.

While Solera is undoubtably built on tech, Neil insists that ultimately it’s their people who make the difference.

He said, “Business development starts with your people and for us that means excellent account management. People buy from people and if you can create a bond of trust with your customer it will help to set firm foundations and opens doors to present new opportunities or increase the use of products and services for mutual benefit. At Solera, we’re focused on building a strong, knowledgeable account management team with significant industry experience, so we understand the challenges ahead and can tackle them together with our products and services.”

Partnerships

The fourth method of achieving business development is through enhanced partnerships and acquisitions.

“The claims eco-system has always required a collaborative approach and even more so with the advancement of digitalisation in the claims process,” Neil said. “Solera/Audatex has more than 500 market-leading integrations with partners across the claims ecosystem, from parts companies, claims management systems, to BMS, diagnostic providers as well as OEMs and other data and parts providers.

“Managing this network of connections is no easy task for the team. However, at the core of most our partnerships is often a secure, reliable two-way data feed, providing the detail behind every decision and highlighting areas for improvement, where time savings and efficiencies can be identified to further streamline claims management processes.”

Elsewhere, the aforementioned imaging solution delivered by GT Motive was developed in collaboration with JDK Technology, while Allianz X, the digital investment arm of Allianz Group and majority shareholder in GT Motive, has also recently acquired Innovation Group to develop its own claims and technology solutions.

However, the most striking example of business development through acquisition is Steer Automotive Group, which has mushroomed from four sites in 2018 to 56 sites now – with more to come.

Richard Steer said, “We’re probably having conversations with 10 people at any one time, four or five of those conversations are serious. We see a massive runway in front of us.”

Differences

Of course, no business is the same in terms of ethos, ambition or resources. As such their avenues of development will not be the same either.

But the need to keep evolving is universal for anyone hoping to keep pace with fast-moving technology and the ever-changing customer – and in an industry that is in the midst of probably its greatest ever reinvention.

Facing today’s unique challenges, it would be all too easy to think only of the short-term and assume that the future will take care of itself. But progress is not inevitable – it’s up to us to create it.