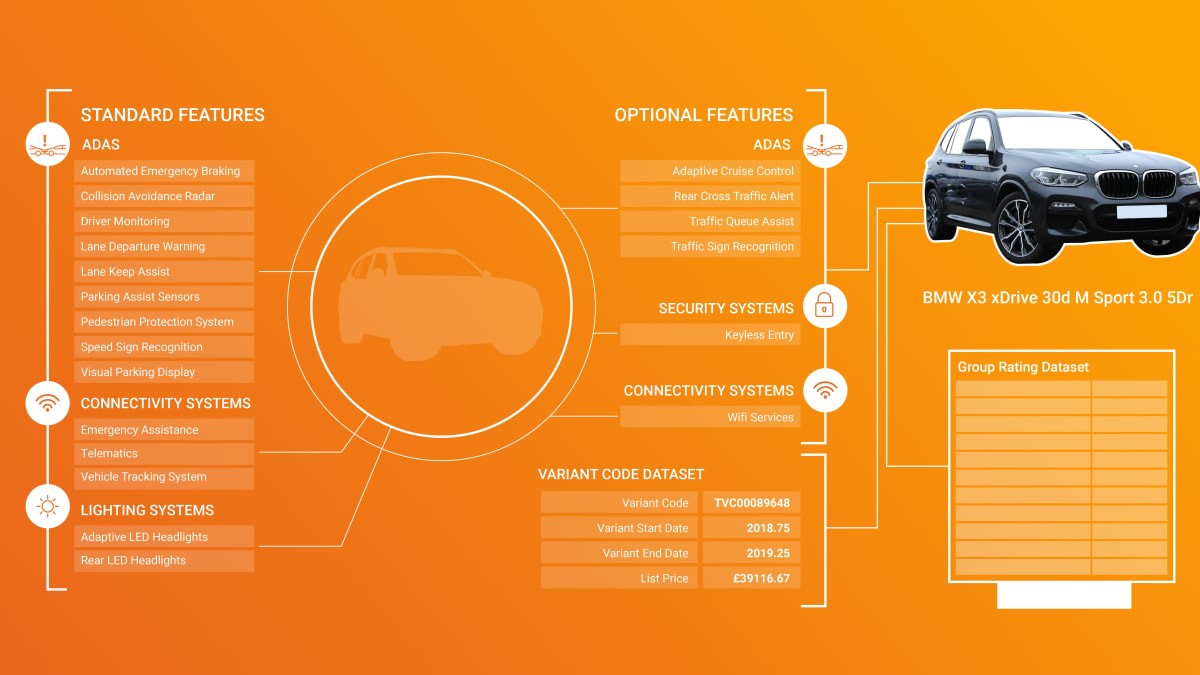

Zenzic, the organisation dedicated to accelerating the self-driving revolution in the UK, has announced funding for a proof-of-concept consumer safety rating for Automated Driving Systems, via Thatcham Research and CAM Testbed partners.

Initially, the independent rating will focus on Automated Lane Keeping Systems (ALKS). This technology could see motorists driving hands-free on UK motorways at limited speeds within a year. The goal is that this project will act as a basis for consumer safety rating of future Automated Driving Systems, and it is anticipated that it will later be adopted by consumer safety organisations such as Euro NCAP.

The project, which is funded by the Government’s Centre for Connected and Autonomous Vehicles, and coordinated by Zenzic, will be led by Thatcham Research, and brings together UK expertise in safety testing. Organisations from the world-leading CAM Testbed UK will work together to develop capabilities and test procedures that will evaluate future connected and automated mobility systems like ALKS. Partners include Automotive Electronics Innovation (AESIN), Warwick Manufacturing Group (WMG, the Midland Future Mobility Testbed), HORIBA Mira (Assured CAV) and IDIADA (CAVWAY).

The future independent consumer safety rating scheme will support the safe adoption of Automated Driving Systems by giving UK motorists and insurers greater clarity around the performance and safe use of automated technology. It aims to be the first of its kind in the world to independently rate the performance of Automated Driving Systems and combine virtual and physical testing.

Jonathan Hewett, Thatcham Research Chief Executive, comments, “The advent of Automated Driving promises to bring a host of benefits spanning safety, mobility and the environment. To realise this potential, we are developing an independent consumer safety rating scheme to foster confidence in the technology and its ability to control the vehicle.

“Not all Automated Driving Systems will be made equal. Therefore, an independent consumer safety rating will drive best practice, while helping consumers to make informed choices and trust that it is safe to relinquish control.”

Mark Cracknell, Head of Connected and Automated Mobility at Zenzic said: “Zenzic is pleased to announce the launch of the Consumer Safety Rating project alongside Thatcham Research and partners from CAM Testbed UK. It is an extremely exciting time for CAM, and the aims of this project will not only provide confidence in safety, for both consumers and insurers, but it could also place the UK as a global leader in the introduction, adoption and use of Automated Driving Systems.”

The project aims to have a proof of concept delivered March 2022