It seems that for a decade or more the familiar refrain within the industry has been that it’s changed more in the past five years than the previous 50.

Before Covid-19, the rapid development of technology was the prime driver of that change.

While that is still true, the pandemic has thrown a raft of new disrupting dynamics into the mix – many of which appear to be here for the long term.

These include but are not limited to:

- Changing consumer habits – working from home where possible has now become the norm. Although this does not directly impact the repair sector, where the workforce needs to be on site, its impact is nevertheless noticeable with reduced traffic volumes (90% of pre-pandemic levels) and, more pertinently, a noticeable shift in journeys from the traditional weekday rush-hour to weekends.

- Supply chain disruption – with reports of China facing a new surge of Covid outbreaks, the steady recovery of the supply chain experienced in recent months may prove to be a false dawn. Trend Tracker’s UK Motor Claims and Body Repair Report revealed that one if five repair jobs is still being delayed by a lack of parts, with lead times now up to 59 days. Meanwhile, the huge decrease in production of new cars continues – there were 6.5 million fewer vehicles registered in the top five European markets in 2020 and 2021 compared to the previous two years, with a further shortfall of 1.1 million in the first quarter of 2022. This has resulted in record increases in the value of used cars, and placed huge stress on mobility (Steer Group has reported a £1.2m increase in mobility costs in the last year).

- Energy costs – the war in Ukraine has seen energy prices soar, with the NBRA now estimating that the average bodyshop faces annual bills in excess of £65k. The impact of this inflation has been softened slightly by the Government’s Energy Bill Relief Scheme, which fixed costs for the six months between October and March. However, fears remains about how the sector will absorb rising prices once the scheme ends, and those fears have not been assuaged by the recent announcement that the Government has delayed its decision on whether to extend the scheme beyond March.

- Repair inflation – arguably the most urgent consideration for businesses, repair inflation is already tracking at 18% per year but expected to increase significantly through 2023, driven up by a perfect storm of increased technology, higher wages, longer repair times and associated mobility expenses. No single sector can tackle this alone, and Paul Sell, Trend Tracker Director, warned, “There is more to come; we’re not at the end of this cost inflation.”

- Skills – the shortage of new talent entering the industry has been a pressing concern for years, but has been exacerbated by the pandemic, with many choosing to leave the sector (retire or change careers) and many more considering doing so. The IMI revealed in the spring that four per cent of automotive vacancies are unfilled. This equates to a shortfall of 23,000 people. However, it predicts this will rise to 160,000 by 2031. Meanwhile, the SMMT found that 73% of companies in the industry are facing recruitment issues. Apart from the operational challenges this poses, it has also led to substantial wage inflation, with salaries for some roles increasing by more than 20% in the last three years.

ACE Age

Of course, running alongside all these issues and in some cases intensifying them (particularly in terms of skills and repair inflation) is what Dean Lander, Head of Repair Services at Thatcham Research, calls the ACE Age. This refers to autonomy, connectivity and electrification.

The mainstream adoption of EVs has been well-publicised, and although high energy bills has slowed uptake in recent months there is still expected to be more than nine million EVs on UK roads by 2030, with a pronounced EV skills gap hitting the industry in 2027.

Autonomous technology is also reaching a crossroads as it transitions from Level 2 to Level 4, which represents a liability shift from the driver to the vehicle. Level 3 has already been approved in Germany with the Mercedes S Class and an application for UK use has now been submitted.

Dean said, “If it’s approved, it will be the first legal Level 3 car in the UK. But it won’t be the last and if you’re running a prestige centre, you could well find yourself repairing one in 2023.”

The government is fully committed to this agenda, and announced in August plans which could see self-driving vehicles on UK roads by 2025, with some automated vehicles on motorways as early as next year.

The then Transport Secretary Grant Shapps said, “The benefits of self-driving vehicles have the potential to be huge. We want the UK to be at the forefront of developing and using this fantastic technology.”

Meanwhile, connectivity will pose a whole new challenge. There are already 28 million connected cars on the road now, and when Over the Air updates become commonplace the risk of cybercrime could become the most urgent consideration facing the industry.

Although at varying stages of adoption, all three of these technologies are changing the incident repair landscape – and will change it to an even greater degree in the future.

Segmentation

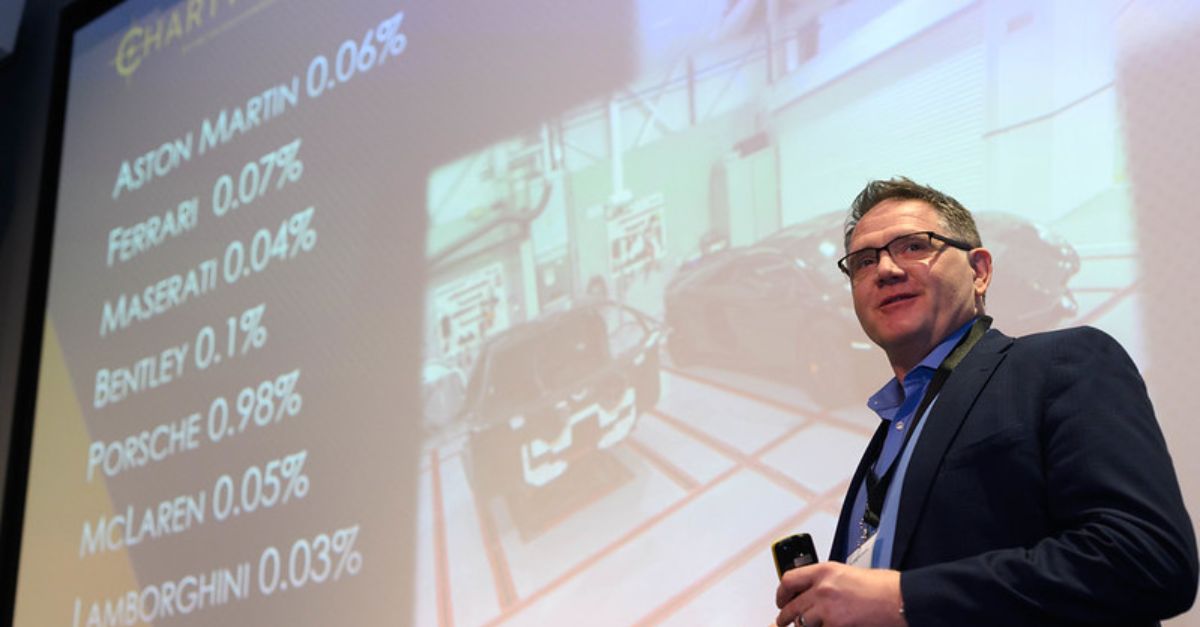

One consequence of this is the greater scope for businesses to differentiate from competitors either in terms of services, jobs, skills or customers. This segmentation of the market is taking place in different ways, with some repairers aligning themselves with insurers or manufacturers, and others focusing instead on a single sector of the car parc, such as prestige or fleet.

Just one example is Komoo, which has been established to provide repair services exclusively to the vehicle rental and fleet sectors. Its goal is to provide a nationwide network of fixed-based repair sites and Repair Cubes providing a dedicated and sustainable fleet repair solution that offers round-the-clock service, quicker key-to-key times and less downtime for fleets.

There is a third option – safety in numbers. Although different business models, both the Fix Auto UK network and Steer Automotive Group are growing at pace, with more and more single-site independents coming to the conclusion that meeting the training and tooling costs of being a one-size-fits all repairer is no longer viable.

Whatever the strategy though, current economic pressures and the wave of new technology still to come are forcing many bodyshops to re-evaluate their businesses to remain sustainable.

Dean said, “Electrification, autonomy and connectivity are the three things that are bringing the challenge to your business and you need to decide what you need to do, how you need to adapt, and what you need to change. We’ve passed the point where we can ignore these technologies.”

Capacity

But while the ACE age is coming, the pandemic has created more immediate challenges, not the least of which is capacity.

A survey by the NBRA earlier this year found that there were more than 100,000 damaged vehicles waiting to be brought in for repair, with drivable vehicles taking five weeks longer to get booked in compared to before the pre-pandemic. Meanwhile, Trend Tracker’s research found that 63% of repairers said they had no more capacity – and this was before the onset of winter.

While this presents urgent operational challenges for bodyshops, it is also a long-term opportunity to reset the established insurer-repairer dynamic.

Not all have recognised that the pendulum of power in the supply chain is swinging their way, but Richard Steer, CEO of Steer Automotive Group, has urged them to change their mindset and be more selective about which jobs to accept. This, he argued, would reduce friction and cost, while also putting them in a stronger position when negotiating contracts.

He said, “I’ve never seen capacity challenges the likes of which we have today. We’ve got 20% more work than we can possibly handle so we have to choose which cars we’re going to repair. But the repair industry has a habit of accepting every job offered. It’s ridiculous. Why take 40 repairs when you can only manage 30? We need to change that mindset.”

His sentiments were echoed by Chris Brightmore, CEO of Chartwell Group, who said that too many repairers were still being led by others. He said the time is right to pause that and put your own priorities first.

He said, “My frustration with this industry is we get driven by someone else’s average or direction. We never stop and ask ourselves, ‘why am I in this market, why does it suit us, and why should I proceed?’”

Insurers

But if this is an opportunity for repairers to reset, the same applies to insurers. While capacity issues in the market may put bodyshops in a stronger position in the long-term, it’s also true that the challenges they are now facing are extreme and many have called for greater support from the insurance industry.

Their calls have received a mix response, but not every insurer is created equal and among those actively developing stronger relationships with its network is LV=.

Apart from supporting repairers on the path to net zero, as part of its Green Hearts Standard, it has also introduced a new Energy and Inflation Support fee (£75 per job) to help under-pressure bodyshops absorb rising inflation.

Michael Golding, Network Manager, said, “The cost inflation within the supply chain is undoubtedly an ongoing concern. In addition to further financial support we provide our network through labour rate increases, we are also helping with other areas like covering Audatex fees, minimising aged debt and fast payment terms, PAS2060 and Green Heart Standard financial support. We have also recently introduced a Outperform + rate scheme for network repairers who go above and beyond with their performance.”

Meanwhile, Admiral has also reassessed it relationship with repairers and in September announced it would only work with ‘a select number of industry leading repair suppliers’.

In a statement, the insurer said, “As part of our mission to provide the best possible customer service, we have undertaken a strategic review of our repair network operating model and we are making some changes as a result.

“Our new network model will enable us to focus on strategic partnerships with a select number of industry-leading suppliers. This means we can more closely manage our customer journey and have the optimal performing repair capacity for today, and for future business growth.”

Partnerships

Ultimately, the unprecedented dynamics within the market offer an opportunity for new levels of partnership and collaboration.

But it’s hard to focus on long-term gain in the midst of short-term pain, with NBRA director Chris Weeks fearing that the industry has backtracked on most of the forward steps taken during Covid-19, instead reverting to type in the face of immediate financial stresses.

Marc Holding, Managing Director at The Vella Group, agreed: “When you’re in a period of downturn, you’re under pressure to think short-term and put into practice things that will have an immediate impact. The need to think long-term has never been greater but some businesses haven’t got the balance sheet to do that and there is a degree of opportunism in the industry around rates and contracts.

“I know the word ‘partnerships’ gets thrown around a lot. Sometimes that just comes down to account size or volume, but what it should mean is all striving for the same goal of reducing cost and friction from the processes, while adding value to the policyholder.”