Trend Tracker’s ‘UK Motor Claims and Body Repair Report 2024-2025’ has valued the vehicle repair market at more than £9bn this year despite volumes falling in the insurance repair sector.

The comprehensive report provides up-to-the-minute and essential commentary on the latest market position, and economic and market developments.

Trend Tracker Director and author of the Report, Paul Sell, said, “Amidst sweeping changes—societal, economic, technological, and environmental—the vehicle repair market continues to evolve rapidly. Success in this space depends on adapting to these shifts while balancing the need for investment in repair sector and managing insurance costs for consumers – by accessing our reports businesses can stay ahead of market change and not be surprised by changes in volumes or costs.

“However, along with the report being available to purchase, now readers can choose to subscribe to access monthly market updates, keeping their finger on the pulse.”

Hot topics include electric vehicles, the repair market size/share and trends, motor insurance and claims trends including average repair costs, repair volumes, cycle time trends, exclusive consumer survey results delivered by Consumer Intelligence as well as dedicated space for both sustainability and growing claims trends such as the use of AI.

The wide-ranging Report includes:

- Economic insights and industry-relevant data on the impact of recent budget decisions, and staff retention

- The expert view from ECA Business on what impact the Russia Ukraine war and conflict in the Middle East is having on energy costs

- The impact of ZEV mandate for automotive in terms of new car sales and EV discounting

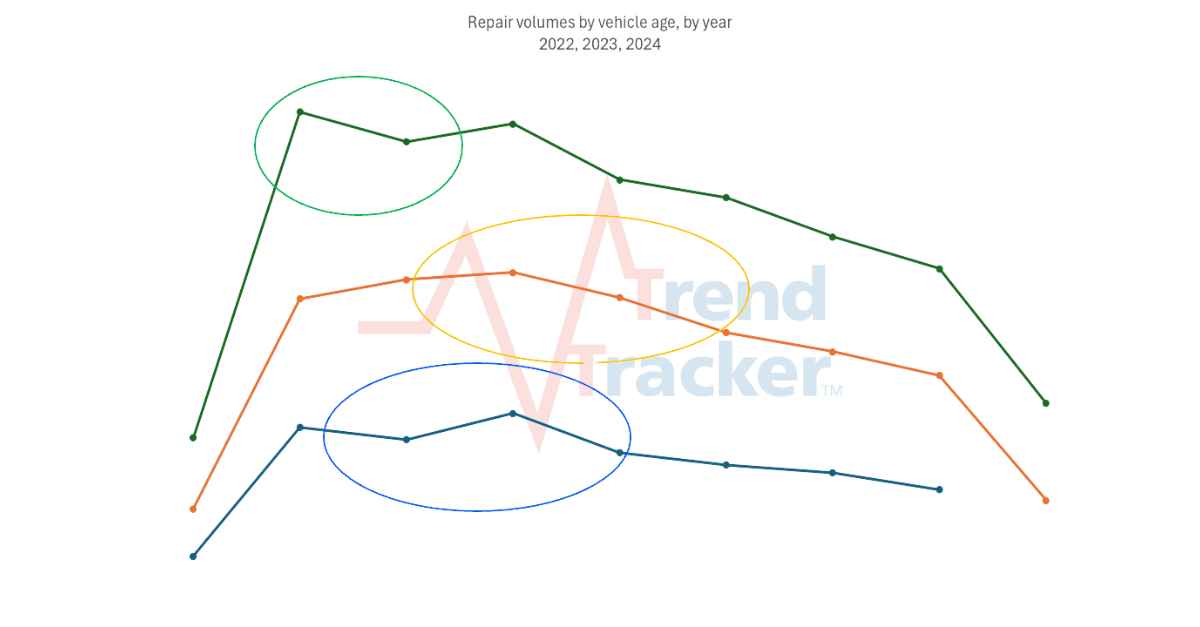

- The detail behind the numbers: such as an ageing car parc (now at an average nine years old); the ADAS penetration in 2015-2023 models, and what the largest bodyshop group market share really means for the independent repair sector.

- Macro data – including the fact there are more cars on the road, increased licence holders and the average trips being taken has increased too, drilling down to industry-relevant questions, such as why are claims still low when most macro factors suggest increases?

- Essential data on EV vs ICE repair costs

- Comprehensive GWP focuses on top five motor insurers showing growth in GWP (premium drivers) explored in detail alongside latest Confused.com data showing premium falls.

- Ensuring repairability: the newly launched Thatcham Research vehicle rating system.

Paul continued, “Our approach at Trend Tracker is to make our data and insight accessible and affordable for the whole market, we can do this through the fantastic support of our sponsors – thank you to Advantage Parts Solutions, The CAPS Consortium, Chartwell Derby – (Powered by Steer), Entegral, Fix Auto UK, LKQ Europe and U-POL Global.

“There are so many people who have contributed enormously to add richness and value to this Report, including Dean Lander from Thatcham Research; Wayne Mason-Drust from NBRA / VBRA; Jade Edwards at Zapmap, Chris Wright from Solera|Audatex, Donna Scully at Carpenters Group; Mark Hadaway from ARC360 and I Love Claims; David Cresswell and Kelly Dalwood at ABP Club, Derren Martin at cap hpi, and Steve Thompson at Trend Tracker’s sister company, Industry Insights.”