The industry has been warned that the already severe skills crisis could be about to get a whole lot worse.

Three factors all brought about by Covid-19 are colliding to create a perfect storm in 2021: the pandemic has meant investment in apprenticeships has nosedived in the last 12 months; older workers have taken stock and many will decide now is the time to leave the industry; while technicians across the board have become disengaged from their employers and have already decided to ‘move on’.

That was the stark warning issued during series three, episode two of the ARC360 webinars, which focused on ‘The Human Side of Business’.

Taking part were panellists Gary Fay, CEO, indentifi Global; Steve Thompson, board vice chairman, AutoRaise and managing director, Industry Insights; and Howard Wolstencroft, managing director, H Samson (Bolton) Ltd.

Talent pool

Gary said, ‘The talent pool is getting smaller, there is absolutely no doubt about that. I think Steve said in 2018 than by 2030 we could fall off a cliff in terms of being able to meet service levels and repair enough cars. I think it could happen even sooner than that. It’s now a necessity to bring in new talent and if you don’t do it your business will simply run out of people.’

While the lack of investment in apprentices and the increased likelihood of older technicians making different choices around work/life balance are both understandable consequences of the pandemic, it is less clear why this health crisis might encourage staff to move on. But that is to ignore the human toll of repeated lockdowns.

Steve said, ‘The human impact has been really hard. It doesn’t matter what age group, it’s been tough. And the longer it’s gone on, the tougher it’s become. As businesses we are more positive than we were in April and May 2020, but maybe we’re not as positive as people because of the fatigue of Covid-19.’

Change

Seeking change is a natural response, and Gary believes that over the course of this year more and more people will decide to act on decisions they have already made.

‘The disengagement has already happened,’ he said.

However, business managers do still have a chance to row back from the abyss by engaging with their colleagues on a more individual level – especially those who are working from home or furloughed.

Gary urged managers to talk to their colleagues about things other than work, to show an interest in them as people and emphasise that they are valued for more than just their productivity.

He said, ‘If you’re not doing it, you’ll be licking your wounds in a year’s time because they won’t forget it. You might have the attitude that ‘if they leave, they leave’, but there aren’t many opportunities to replace them.’

Apprentices

Those opportunities are shrinking still further due to the lack of fresh blood coming into the sector. AutoRaise has urged the entire industry to put the focus back on apprentices, many of whom have been hit hard by the pandemic.

Steve said, ‘We need to remember how tough it is for the school-leaver age-group. It’s dreadful for them. They are missing out on education and their social lives, but on top of that they are trying to get their careers off the ground in the middle of a pandemic and a recession. It’s pretty bleak.

‘AutoRaise is trying to support them and create opportunities for them within the body repair sector, but that requires everyone in the industry to play a part. It’s not just the responsibility of repairers or work providers. It’s everyone’s responsibility to promote the positives of our industry and do our best to give this age group a future.’

Howard agreed. He explained how H Samson (Bolton) Ltd has developed close ties with Bolton College and regularly invites students on site.

‘Bodyshops shouldn’t ask if they can afford apprentices. They should ask if they can afford not to have apprentices. If you don’t then it becomes a vicious cycle because when you need more people you’ll have to go to market and pay the full rate for a qualified technician.’

He also demonstrated the value apprentices bring with a quick calculation which weighed up the investment in an apprentice against the savings it could bring in supporting a more senior technician.

Volumes

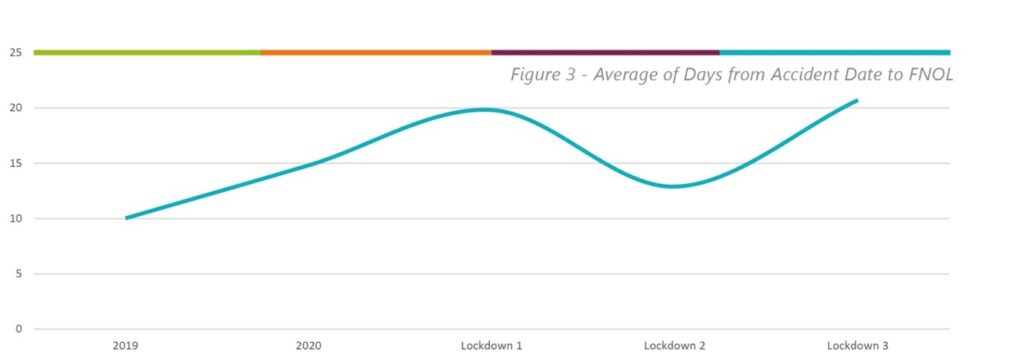

Ultimately though, almost every decision a bodyshop makes will be driven by volumes, and it seems Lockdown 3:0 is having a negative effect on work levels. According to an ARC360 poll a third of respondents have seen a ‘significant’ decrease in claims volumes in the past two weeks, with 44% reporting a ‘slight’ decrease. As a result, 46% of respondents are now operating at 60-80% of normal volumes, with a further 35% saying they have fallen even further, to between 40% and 60%.

Planning for the future can seem impossible during such extreme conditions. Encouragingly though, it seems many are still pressing ahead with growth strategies, particularly those based in the Midlands and further north.

Gary said, ‘There are pockets of optimism. London closed down hard and hasn’t come back on stream yet, like much of the South East, but there is much more confidence and activity from Northampton upwards. Some people, mainly groups, are executing their strategies and are quite buoyant, but smaller independents are standing still, which is really regression.’

ARC360, in association with I Love Claims, is supported by corporate partners BASF, BMS, Copart, EMACS, Entegral, Enterprise Rent-a-Car, Mirka, Nationwide Vehicle Recovery Assistance, S&G Response, Sherwin Williams and CAPS; partners asTech, The Green Parts Specialists, Indasa, Innovation Group and Prasco; and strategic partners AutoRaise; NBRA; RepairTalks; and TrendTracker.