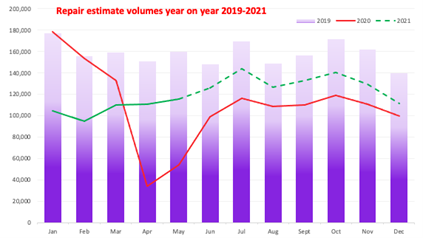

Data showing signs of ‘summer spike’

Industry data is showing signs of a ‘summer spike’ according to Trend Tracker, as repair volumes look to be improving in June with 57,779 repairs so far during the month (as at 13June).

At the same stage in May there had seen 43% of the month’s volume, which means June could see circa 130,000 repairs, reaching circa 88% of 2019 volumes.

ADAS continues to impact

ADAS – advanced driver assistance systems – has been a buzzword within the incident repair industry for a number of years, but despite that there still appears a widespread lack of indepth understanding of the technology.

The introduction of Thatcham Research’s Insurance Industry Requirements (IIR), backed by more than 30 insurer brands, in July 2020 and its subsequent implementation at the end of March 2021 has only emphasised that knowledge gap, with a flurry of activity evidenced as many in the aftermarket scrambled to make up the ground.

Fix wins franchisee rate relief battle

Fix Auto UK has supported Matt Wright and his fellow directors at Fix Auto West Hampstead, Fix Auto High Wycombe and Fix Auto Hoddesdon to win a nine-month battle to secure £110,000 in business rates relief packages.

Matt said, “Having our applications refused has been frustrating, especially as we know many fellow Fix Auto UK sites and others outside of the network have successfully gained grant support. We met every element of the criteria needed and so just kept pursuing.”

Ian Pugh, Fix Auto UK’s Managing Director, said: “The priority of every business is survival since the Coronavirus pandemic took hold. While we are seeing signs of a recovery, repair volumes have been dramatically down for more than a year now so every penny that can be injected into a business helps cashflow.”

Tractable earns unicorn status

Tractable has raised $60m at a $1bn valuation during a series D round of funding making it a world first computer vision unicorn for financial services.

Founded in 2015, the London based start-up will help Tractable expand its AI-based technology to improve the claims experience.

Adrien Cohen, Co-Founder & President at Tractable, said, “Reaching unicorn status is a symbolic milestone – what really matters is what we are doing next. We are planing to expand our AI platform – adapting it to inspect a vehicle’s condition when buying, selling, renting your car, and expanding into visual appraisal of property damage after a natural disaster. So that when accidents or disasters hit, our AI is here to help.”

asTech acquires Mobile Tech RX

Repairify, trading as asTech, has acquired automotive and collision reconditioning app – Mobile Tech RX.

Mobile Tech RX is an industry leading automotive repair app with over 4,000 companies and approximately 6,000 active users that enables technicians to estimate, invoice, manage teams and collision workflow, process repair orders and capture data on-the-go through their mobile devices.

Wing mirror repairs costing millions

Volkswagen Commercial Vehicles has calculated that damage to wing mirrors has cost UK van drivers £655m in repair costs in their lifetime with additional losses racked up due to vehicle downtime.

According to the research, a total of 62% of van drivers have had their wing mirrors damaged with over a third admitting it has happened multiple times.

Replacement wing mirrors are the single most common repair that Volkswagen Commercial Vehicles technicians handle each year, with glass and mirrors accounting for 10 times more repairs than any other part.

Underwriting profits surge in 2020

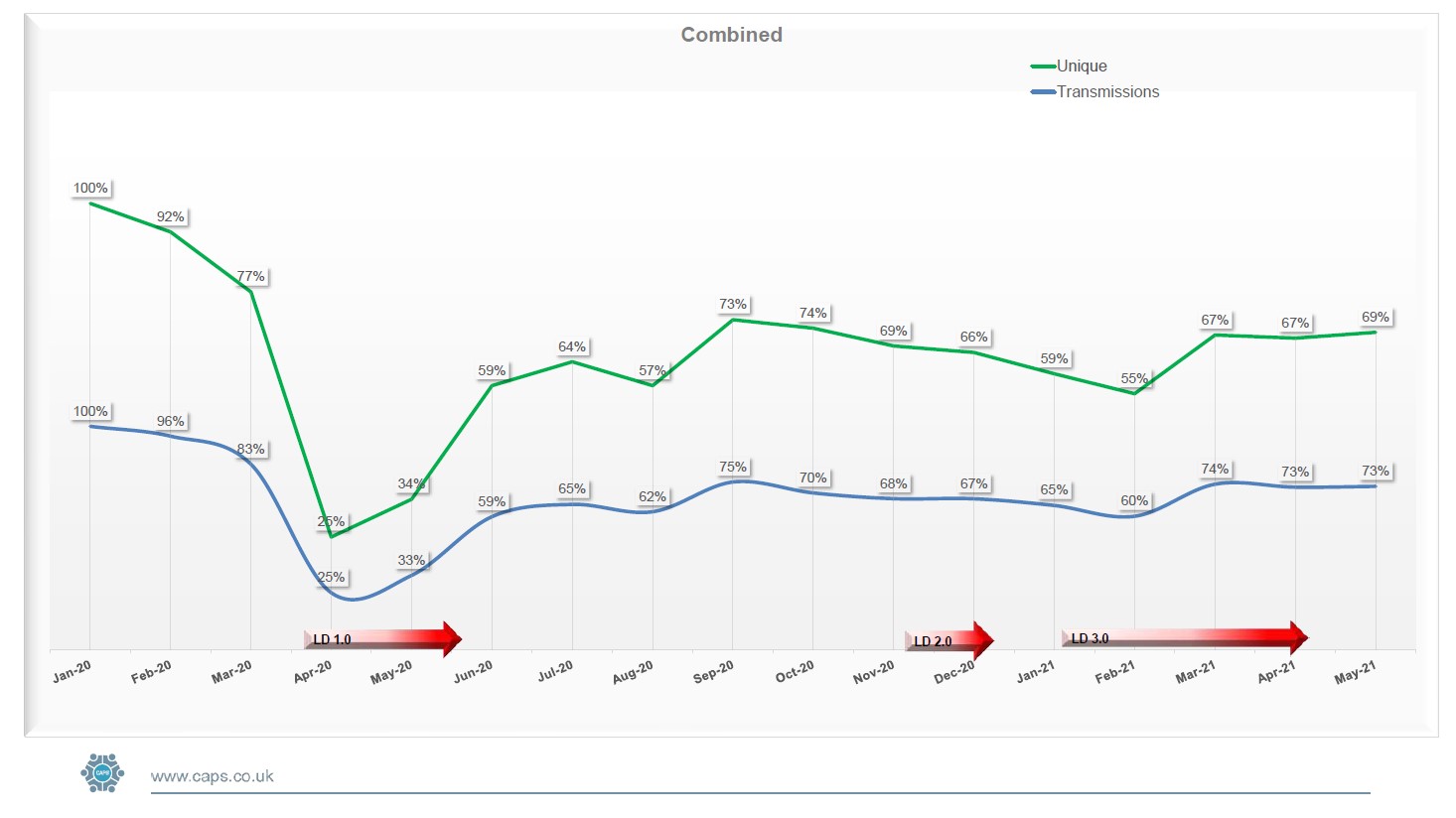

The UK motor insurance market recorded its best underwriting profit since records began in 2020, with a Net Combined Ratio (NCR) of 90.3%, according to EY’s latest UK Motor Insurance Results.

The profitable NCR was principally driven by the COVID-19 lockdowns which resulted in a 20% fall in vehicle usage and a subsequent 28% drop in the number of motor claims.

However, EY predicts that premium rate cuts in Q1 2021 and the upcoming FCA pricing reforms will contribute to this profitability being short-lived, despite the whiplash reforms finally taking effect.

EY forecasts that the NCR for 2021 will be a loss-making 103%, falling further into the red in 2022 with an NCR of 112%.

Vitality launches new motor product

Vitality, in partnership with Covéa Insurance, has introduced a new rewards-based motor insurance product to enable drivers to measure and improve their driving behaviour.

James Gearey, Managing Director of Personal Lines and Protection for Covéa Insurance added: “Our partnership with Vitality is a major milestone for our business strategy and technology roadmap. It is also a really exciting development for the wider insurance market. The regulatory environment is changing as are customer needs. We have to evolve and innovate to make sure we deliver products that provide value and allow consumers the choice to live their lives in the way that they want.”

Industry figures back Automotive 30% Club

Victoria Turner, CEO of Activate Accident Repair and CCO of Activate Group has joined the Automotive 30% Club.

Fellow industry leader – Simon Smith, managing director of Solus Accident Repair Centres – joined the Automotive 30% Club at the beginning of June.

The voluntary network of motor industry leaders aims to improve gender balance within the industry with a goal of filling at least 30% of automotive leadership positions with diverse women by 2030.

Victoria said, “Joining the Automotive 30% Club is just one part of our plan to further develop the inclusive, open-minded culture across the business.”

SMART adds Exeter to portfolio

SMART Bodyshop Solutions has added SMART Bodyshop Solutions Exeter to its group portfolio.

The latest addition adds to the groups geographical coverage which now supports the state of the art site in Cardiff along with The CARS Kidderminster site which SMART Bodyshop Solutions acquired back in October 2020.

The new business is located at the former SHB sales site and will be headed up by Andy Crisp.

Royal Mail rolls out 3,000 EVs

Royal Mail is rolling out a further 3,000 electric vans for use in Clean Air Zone (CAZ) areas.

The additional vehicles, predominantly Mercedes e-Vito, e-Sprinter and Peugeot e-Experts, build on its existing fleet of 300 electric vans and will be supported by a charge point installation at all participating delivery offices.

The first batch of the new vehicles is expected to enter operation in October.

Volvo explores future of steel

Volvo Cars has teamed up with Swedish steel maker SSAB to jointly explore the development of fossil-free, high-quality steel for use in the automotive industry.

The collaboration with SSAB is the latest initiative that supports Volvo Cars’ overall climate action plan with its ambition to be a fully electric car brand by 2030, with only pure electric cars in its line-up. The plan also seeks to tackle carbon emissions in the company’s wider operations, its supply chain and through recycling and reuse of materials.

In the short term, these and other steps aim to reduce the lifecycle carbon footprint per car by 40% between 2018 and 2025. By 2040, Volvo Cars’ ambition is to be a climate-neutral company.

XpressCentres hits £1m milestone

XpressCentres has reached £1m milestone in retail sales since the launch of its new website in early 2020.

The business which has 38 facilities across the country offers a same day car repair service, specialising in minor accident damage such as bumper scrapes and dents, minor wing damage and refinishing.