ARC360’s webinARC 3.6 was all about hope for the future, encouraging repairers to look ahead to better days and, crucially, providing the data to back up this optimism.

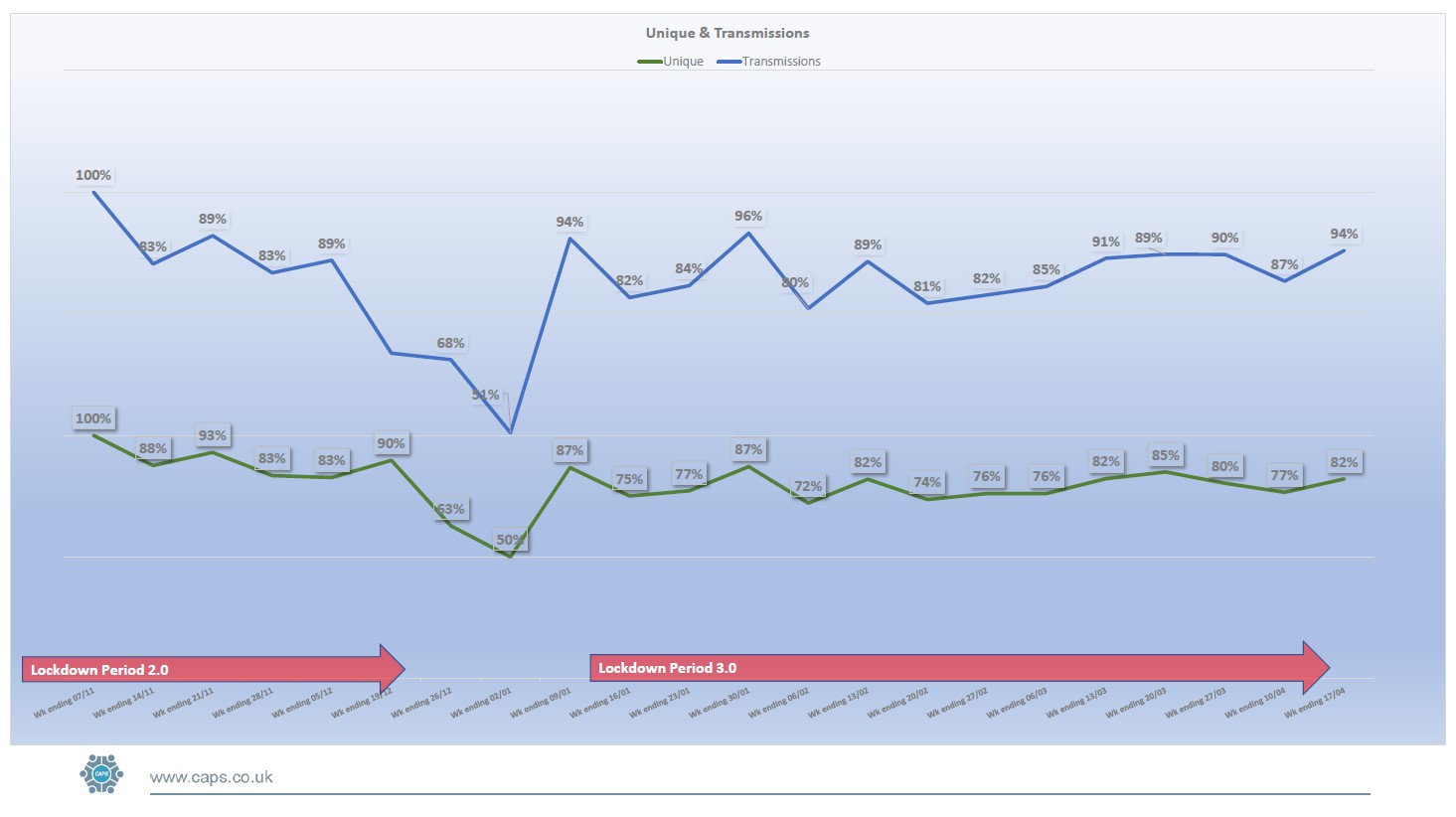

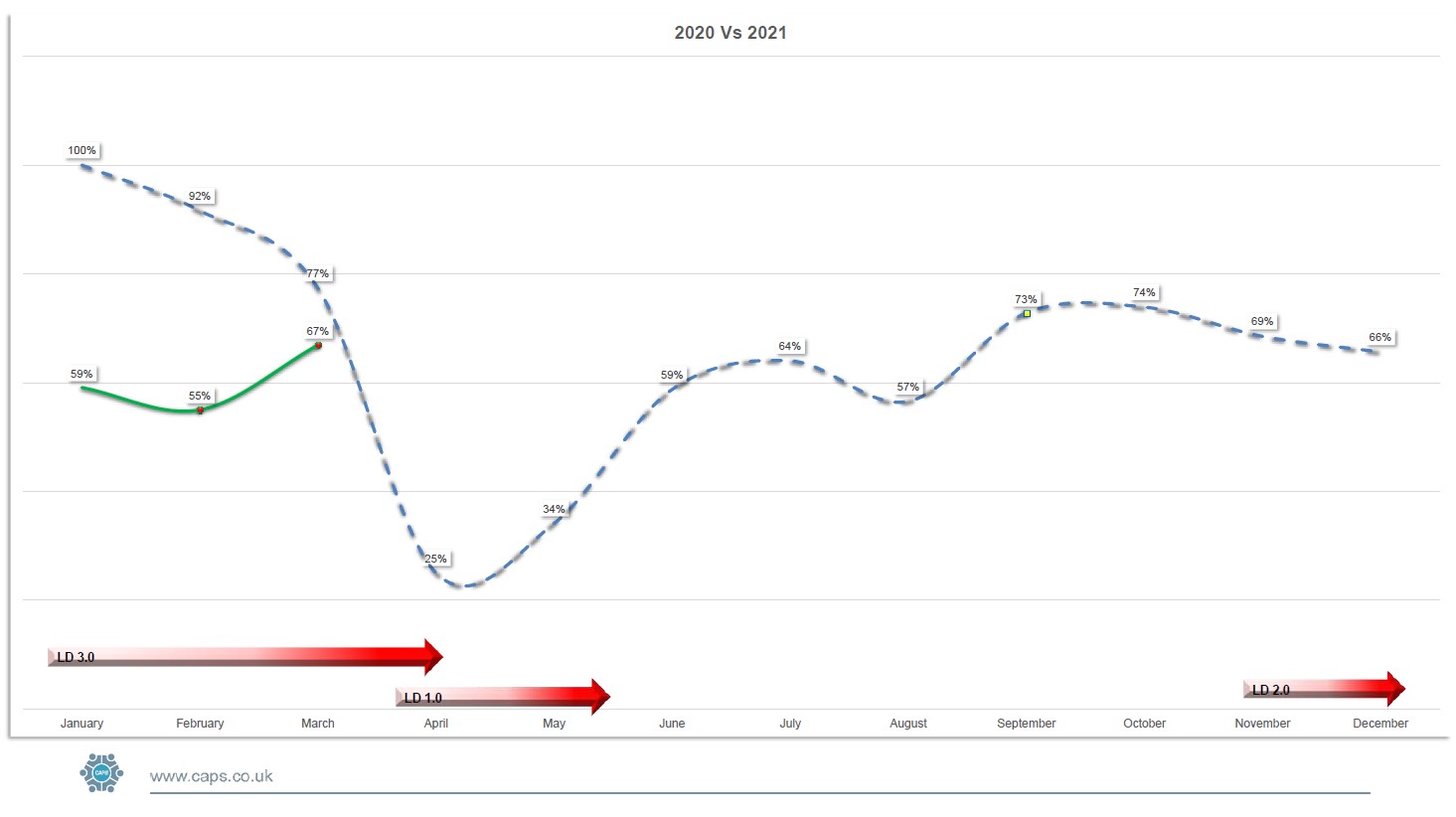

While acknowledging that the last year has been the ultimate annus horribilis for the automotive aftermarket, the session, Back to Business, also highlighted the trends – from traffic volumes to claims volumes – that indicate a significant upturn in the coming months.

Taking part were Chris Weeks executive director, NBRA, and Paul Sell, new director of Trend Tracker, whose survey in partnership with ARC360 and NBRA: UK Body Repair Market Emerging from COVID-19 Spring 2021, provided much of the insights upon which the optimism was founded. The survey forms part of a broader piece of work currently being undertaken by Trend Tracker and available in May.

Painful

Paul explained, ‘We’ve experienced the biggest drop in GDP since records began so it was always going to be painful. We had nine million people on furlough at its peak. But there are lots of signs of optimism now, and I think people are starting to see how they can come out of this and even come back stronger than they were before.’

Chris agreed, saying that claims now are at 110,000 per month across the industry compared to 140,000 in 2019, but he can see them rising to 130,000 at some point this year.

He said, ‘The industry has been starved of work for such a long time, but we’ve survived the worst now, and the strength, resilience and innovation we’ve shown has been astonishing.’

Both the challenges of the past 12 months and the brighter hopes for the next 12 were encapsulated in the Trend Tracker report, which garnered information from more than 200 bodyshops across the UK, ranging in size and turnover.

Splits

In simple terms, it found the industry could be broken down into quarters in terms of how the virus had hit them, with the bottom quarter barely surviving, the middle two quarters struggling but coping, and the top quarter actually emerging stronger.

Chris said, ‘This has definitely polarised the industry. There is a top echelon that had the resources and capital to manage this crisis and expand and grow, but there is also a group that is really struggling, really short of work.’

The survey found that most respondents reported a decrease in turnover over the last year of between 21% and 60%, although a third said they had lost more than 41% of turnover, with the same number saying that even now it is less than half of what it was pre-pandemic.

For many, it has only been support from the government, which has amounted to a staggering 17% of GDP, that has kept them afloat. In fact, only a third of respondents have got by without increasing debt or borrowings, while another third have deferred VAT payments and crossing their fingers that volumes return before they are due.

Volumes

In terms of volumes, the results are again disparate, identifying clear winners and losers in the last year.

At the top end, 29% of respondents say they are back operating at more than 71% of normal volumes, but against that 26% say volumes are still less than half of what they were.

As such, many now are forced to take on jobs with little or no profit margin, and while it may suit at present some work providers could face a backlash if volumes continue to increase.

Paul said, ‘People are taking work where they can get it now, but that will change. Some work providers have enhanced their reputations and people will want to work with them in the future, but others less so.’

Support

In terms of numbers, the survey found that almost half of respondents were not satisfied with the financial support offered by work providers during the crisis, with more than a third also unhappy with how their work providers managed payments and debts to assist cashflow.

‘The response from some insurers doesn’t surprise me,’ Chris said. ‘There have been some heroes, but overall I think their response has been and still is very disappointing. If demand for work was low from repairers then I am sure those providers who have looked after their repairers would be getting preferential treatment. We’re not at that point yet unfortunately, and insurers know that. That means repairers still have no choice but to take on jobs that barely cover costs.’

He said the NBRA will now be doing an evaluation of work providers and insurers, to identify the level of support offered, and by whom.

Meanwhile, the split in volumes is mirrored in investment plans, with one in five respondents increasing investment in areas such as ADAS, EVs and OEM tooling, while nearly the same number (22%) admit that they are likely or very likely to make redundancies.

Optimism

Despite this though, 79% of respondents are cautiously or very optimistic for the second half of the year, with 76% confident their business with absorb whatever else Covid-19 has to offer.

And with good reason. According to Trend Tracker, volumes in May could return to 85% of what they were in May 2019, and although that might still seem low, it is a massive 250% increase on what they were in May 2020.

There is a fair chance numbers will spike further thereafter, with foreign travel still severely limited and many people opting for staycations this summer.

Paul said, ‘The numbers are climbing quicker than we anticipated. It’s still a difficult time, but I think there is a lot for people to be encouraged about.’

ARC360, in association with I Love Claims, is supported by corporate partners BASF, BMS, Copart, EMACS, Entegral, Enterprise Rent-a-Car, Mirka, Nationwide Vehicle Recovery Assistance, S&G Response, Sherwin Williams and CAPS; partners asTech, The Green Parts Specialists, Indasa, Innovation Group and Prasco UK; and strategic partners AutoRaise; NBRA; RepairTalks; and TrendTracker.

To download the data slides used during the webinar click the PDF links below.

Click here to register interest in the full Trend Tracker Emerging from Covid-19 report to be published in May. The first 50 to do so will get 25% discount off the final report price.