No two businesses are alike, but the dramatic divergence of operating models and growth strategies within the automotive incident repair aftermarket is now quite extraordinary.

You don’t have to trace back too many years to find a time when the majority of bodyshops were, largely speaking, of a type, following well-trodden tracks of either high volume/low margin, or low volume/high margin.

Although this basic distinction still exists, there are now many more opportunities for business owners who want to create a unique proposition. This has come about because of significant change in two areas – technology and the customer.

Change

Technology incorporates both the product (the vehicle) and the methods used to repair it. Vast progress in both has, while not quite forcing bodyshops to focus on a single aspect of the job, certainly created far more scope for those who want to.

On a broad level, industry-wide developments in electric vehicles, ADAS and the materials used in car construction have inevitably created differentiators between repairers in terms of their capabilities. Those differentiators have been exacerbated by manufacturers, who have adopted these technologies to a greater or lesser degree. As such, the divergence between them has grown, and is growing; while a standard skill set enabled technicians to work on much of the car parc a generation ago, brand-specific training is often now essential.

Challenge and opportunity

This has created both challenges and opportunities for bodyshop owners, who have had to decide if they want to go down the VM-approval route and, if so, which VMs best align with their own company and how many do they need.

Meanwhile, the change in the customer has been no less significant, with different bodyshop strategies emerging to place different priorities on consumer demands such as speed, quality, and environmental impact.

As such, the automotive aftermarket is breaking apart and, in many ways, now is starting to mirror other industries that are much further down the diversification road, such as catering. In fact, for almost every type of food outlet there is now an equivalent repairer model:

- Fast food outlets – fast track repairers

- Street vendors – mobile repairers

- Pop up restaurants – repair pods

- Specialists (world foods/vegetarian etc) – specialists (alloy wheels/ADAS etc)

- Standalone restaurants – single-site independents

- Franchises/groups – franchises/groups

- Gourmet restaurants – prestige repairers

The products are obviously different, but the sharp focus on a type of customer or type of service is similar.

With so many routes to success, we look at just a few of the options out there:

The VM-approved repairer:

The benefits of being able to put a badge above the door are well known. It assures the customer a high standard of repair, secures a certain amount of work from dealers, and, perhaps most importantly, offers the chance for businesses to future-proof themselves through training and access to the latest innovations on the market.

Against this are the obvious cost implications. That training is not free, and in many cases repairers will be expected to invest in expensive tooling and equipment in order to maintain their approved status.

However, not all badges are created equal.

For example, an approved Volkswagen Group repairer will have to budget for about £7,000 per year if they want to retain their badge. On top of that, investment in EV and ADAS tooling could set them back a further £20,000 in the coming few years. This compares to just £700 a year – or even less – for some of the smaller badges.

Variables

But comparisons based purely on cost are overly simplistic.

Paul Chapman is director of Chaplane ARC, an approved repairer for Alfa Romeo, Audi, Chrysler, Fiat, Honda, Hyundai, Isuzu, Jeep, Mazda, Mitsubishi, Nissan, Renault, SEAT, Skoda, Subaru, Volkswagen and Volvo, and a specialist repairer for Porsche.

He said, ‘VWG is expensive, but it provides value. There are already a lot of VWs on the road; they provide about 30% of our workload while we might only see some other brands once a year. Also, SEAT is a growing brand, Skoda is a growing brand, and Audi is a prestige brand.’

He says that having a handful of brands under the same umbrella means investments in training, tooling and equipment can pay off multiple times, and the benefits are not restricted solely to VWG with some of the skills and certifications recognised by manufacturers outside to the group too.

He continued, ‘We’re not a sausage factory. Our ethos is quality over quantity and we rely on our reputation for work. The overall benefit of being a multi-brand approved repairer is that our customers know our repair methods are continually checked against the manufacturer’s standards and that the vehicle is just as safe after repair as it was when it left the showroom.’

Volumes

However, quality over quantity comes at a cost. By not going down the volume route, VM-approved repairers rely more on dealers and word of mouth for work. In the last year especially, this has presented challenges.

Paul said, ‘We’ve suffered with less footfall going into dealerships and dealers not being focused on directing work to us due to other pressures of the business, so we may have to try to find other work providers.’

Either that, or Chaplane will try to attract more customers independently by evolving the business. This could mean targeting the environmentally-conscious driver by securing PAS2060 accreditation, or investing in EV and ADAS technology.

Paul said, ‘We want to be a one-stop shop so we can’t be left behind in terms of technology. The difficulty is knowing when to invest, but you can make as many business plans as you like and sometimes you just need to go with your gut.’

The specialist:

There is still a case to be made for independent shops serving a wide customer-base. However, as the complexity of vehicles increases, more and more are finding that the level of investment in training and tooling is unsustainable.

Speaking on an ARC360 webinar in the spring, Dean Lander, head of repair sector services, Thatcham Research, said, ‘The investment requirements for one business to invest across the board is just too great. A small-sized business trying to repair all makes and models today is on a hiding to nothing. It can’t be done. If I were a bodyshop now I would find a segment in the market and focus on that entirely. You have to define what you’re going to be and either go down a technology or a brand approval route.’

Many bodyshops agree, focusing either on brand or service.

Axiom opted for the latter when it was set up in Colorado to carry out paintless dent removal (PDR) repairs to predominantly hail-damaged vehicles. The strategy prioritised speed and volume, and proved so successful that the business quickly became international.

In the UK, Axiom is now established in Peterborough and Daventry and managing director Jordan Fisher has ambitious plans to operate 25 sites within the decade.

However, the business model has evolved to support this growth. While PDR remains fundamental, it is now part of the repair rather than the repair itself.

Jordan said, ‘The one thing we always knew was that there was a barrier between the PDR industry and bodyshops, and it was a skill under-utilised in the repair process. We wanted to align our skillsets with panel to reduce time and filler as much as possible.

‘Now, every vehicle that arrives with us for repair gets appraised for PDR, and other repair methods such as plastic repair, with the aim of reducing damage size. If we can reduce a four-panel repair into a two-panel repair that will reduce time and materials, while still giving an original repair which is less likely to have any issues resulting in a rework.’

As vehicles get ever-more complicated, and as the environmental impact becomes ever-more critical, the benefits of smaller, cheaper, faster, less intrusive repair methods are obvious.

Jordan said, ‘PDR in bodyshops needs to grow – the benefits are huge, not only on speed and quality but for working around ADAS, EV/hybrid vehicles, and of course for reducing our carbon footprint. With glue pull repair, technology and equipment has come such a long way that less training is needed to be capable of reducing damage so there is little excuse for bodyshops not to be utilising this repair method.’

The SMART repairer:

A strong argument could be made to suggest that the SMART repair sector is the most attractive low-risk entry point for new businesses. Compared to opening a new bodyshop, the original investment is low and technicians do not need to be skilled across multiple disciplines.

Further, SMART repairers meet customer demand for convenience, while the rise of ADAS – expected to reduce the number of accidents but change their type – and a shift from vehicle ownership to leasing could see the demand for quick cosmetic repairs surge in the coming years.

ChipsAway claims to be the original SMART repairer, and its success in the last two decades only proves what can be achieved when you apply new technology to unmet customer demand.

There are now more than 200 ChipsAway vans on UK roads, but that number is growing – and, perhaps worrying for traditional bodyshops, so too is the number of fixed ChipsAway sites. More than 30 have been established so far and, according to Simon Kings, technical director, ‘more will be added over time.’

He said, ‘A number of operators want to add volume to their businesses whilst retaining high margins and it’s a natural evolution moving into a fixed site that enables you to work on multiple vehicles at the same time.’

Franchising:

Apart from the convenience of service, fuelling the growth of the brand is its franchise business model, which marries both independence with support and instant brand recognition.

Simon said, ‘Franchising provides the opportunity to be in business for yourself but not by yourself.’

Support includes franchisor investment in everything from training (70% of its technicians are trained to work on EVs and an ADAS training programme for IIR is being rolled out shortly) to health and safety compliance as well as customer relationship management software and equipment.

Perhaps even more important than all this though, especially for start-ups, is the name. A multi-million-pound marketing campaign across TV, SEO, PPC, social media and print has helped establish ChipsAway as the leader in its sector, attracting 275,000 enquiries in 2020 and recognised by 11 times as many customers as its closest competitor.

Aligning with such an established player in the sector is a substantial competitive advantage.

Simon concluded, ‘Customers like same day repair and we are presently working on a ‘Fixed Price, Same Day’ repair for insurers wanting to provide improved customer experience and service for their customers.

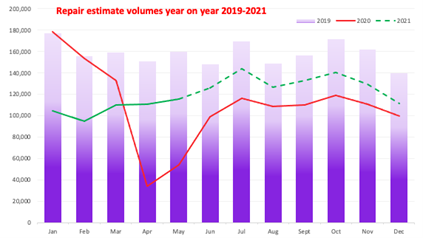

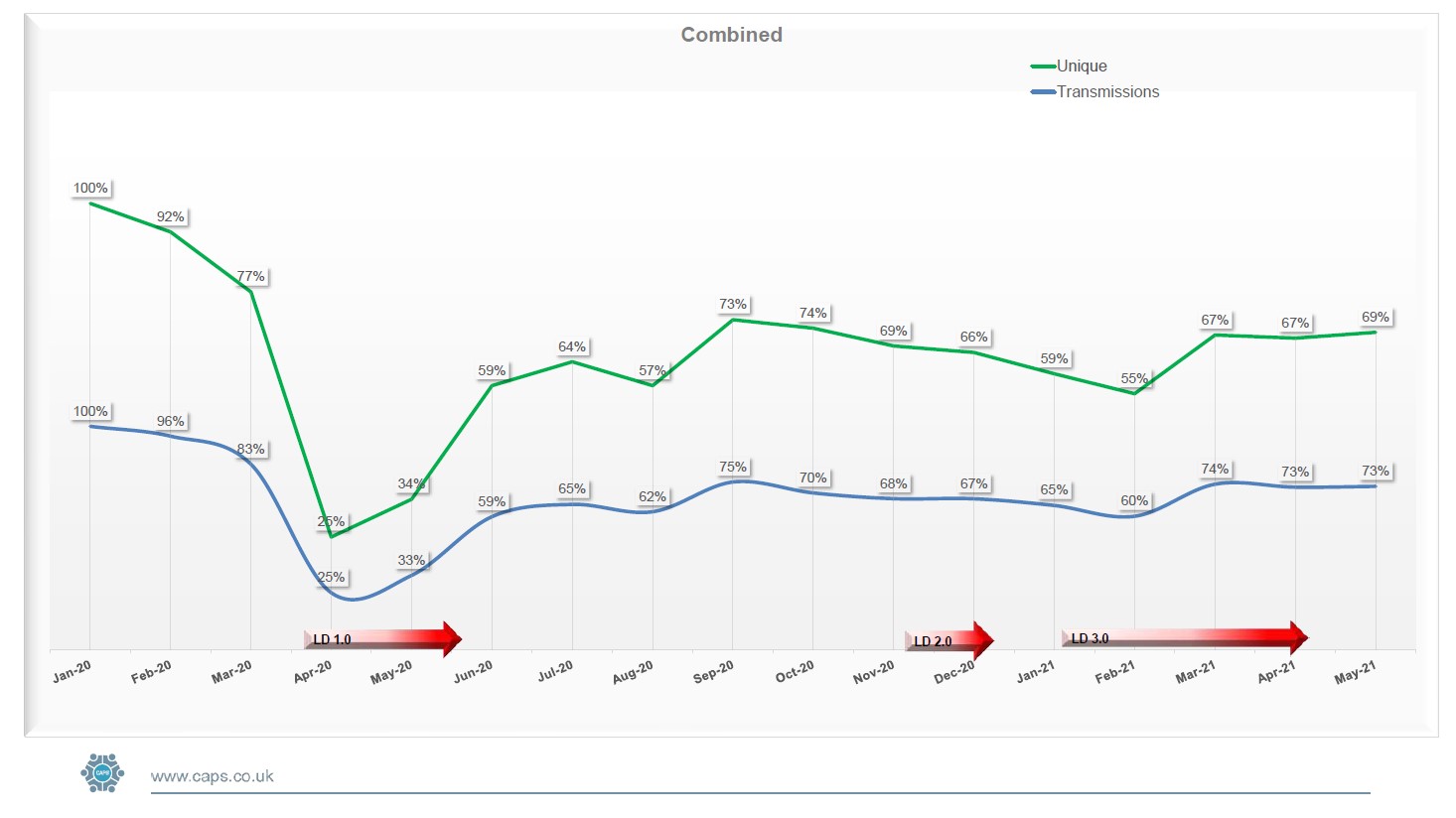

‘Like everyone, we took a hit on lead volumes between March and May last year, but we achieved record lead volumes during the summer and after the most recent lockdown we are now very close to pre-pandemic levels. We expect to see this increase as the restrictions ease further, and to maintain our position into the future as brand leader for retail SMART repair.’

Influences:

Whatever changes were taking place within the industry have only accelerated in the last year, as Covid-enforced lockdowns have given business owners the opportunity to step away from the front line and either initiate the changes they’ve had on the backburner or imagine the changes they want to make.

Equally, the challenges they have faced and overcome during the pandemic has instilled many with the confidence to make bolder decisions.

Speaking to ARC360 late last year, Robert Snook, group director, Business Success Global and MG Cannon, said, ‘I think the coronavirus has taught bodyshops the value of thinking more, not just doing more, and many will be more comfortable with change now than they were in 2019. This will drive more diversification and specialist niche targeting in future.

‘But bodyshops have had a chequered history with investments such as equipment, so before making any new investments they should review their past investment returns and have a more robust structure to better assess future returns on each new investment. This will guide them toward the right investments and keep them away from the wrong ones.’

Future:

So, where are the next areas of opportunity for businesses looking for a space to move into?

ADAS is an obvious one, with six million-ADAS enabled vehicles on the road today and the introduction of the Insurance Industry Requirements at the end of March ensuring that repairers follow vehicle manufacturer guidelines.

But while everyone is looking at ADAS, is something else creeping up in the shadows?

Dean concluded, ‘Alongside ADAS we’re talking about EVs, autonomous vehicles, and connected cars. I think connected vehicles is the thing we’ve all got our heads in sand about still. It’s going to be a real game-changer.’