The third series of webinars hosted by ARC360, in association with I Love Claims, began on Wednesday 13 January, when cashflow and claims volumes emerged as two of the most critical areas of concern going into 2021.

They were not the only priority areas to be identified during the 45-minute session, titled ‘New Beginnings’, with a live online poll also finding partnerships (16%), people management (15%) and forecasting (14%) as key business focuses. But it was cashflow (17%) and especially claims volumes (30%) that remain the areas of most concern.

Lifeblood

Ian Pugh, managing director, Fix Auto, who joined Peter Edgar, head of motor claims operations, RSA, and Gary De Groot, business development director, Innovation Group on the panel, despite a recent positive test for Covid-19, said, ‘Claims volumes are important, but what kills a business is cashflow.

‘Last year was tough, probably the toughest I’ve faced since I’ve been at Fix Auto UK, but this problem isn’t over. I think we’ll continue to zig zag our way through it. Last year it was all an unknown though, so this year we must apply the lessons we’ve learned around furlough and business rates reliefs to maintain a strong balance sheet.’

He said this would be even more critical in 2021 after many businesses had been forced to spend their reserves to survive 2020.

‘We’re going into the year depleted,’ he warned.

Lockdown

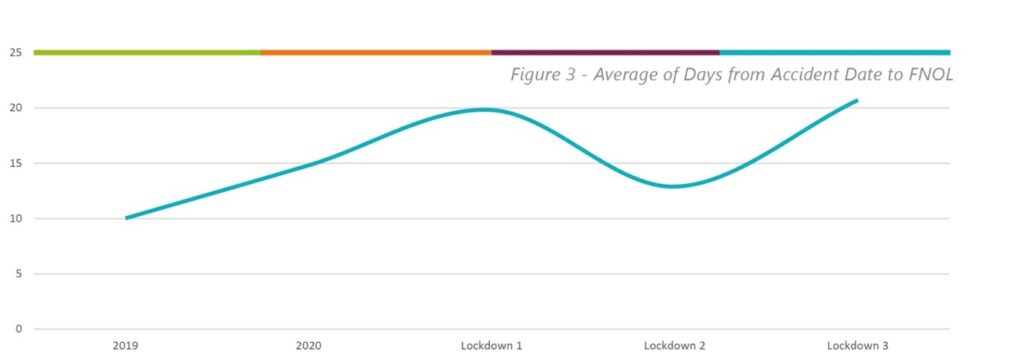

The difficulty facing many businesses, however, is planning. Few would have foreseen three separate lockdowns when Covid-19 first struck early last year, and trying to predict what the virus will do next and how it will impact trade is proving impossible.

Peter warned of even tighter restrictions on the way, which could impact levels again either regionally or nationally, while Gary admitted the fluctuations in volumes that already exist are difficult to manage.

‘There is just no consistency,’ he said. ‘If we knew volumes would be at 65% for the next six months then we could plan for that but, at the moment, you always feel like you’re on the back foot and it creates real challenges for the operational staff.’

Volumes decline

Lockdown 3.0 has not been in effect long enough to accurately gauge its impact, although both Ian and Peter said they had seen work volumes fall in the last few days, sometimes as much as 20%, and if that is reflected across the industry then a return to 50% of pre-pandemic levels is on the cards.

Ian said, ‘If this trend continues, as an industry we need to look at what February and March holds for us, because once we’ve finished all our work in progress it could get quite tough. I can see the industry dropping down to 50%, and that’s not sustainable.’

He called for continued support from other sectors of the industry to protect their supply chains.

But while there are undoubted obstacles still to come, the mood within the industry remains optimistic, with a series of live online polls highlighting the robustness within the sector. Although the vast majority of respondents reported a slight (49%) or significant (29%) decrease in claims volumes since the start of January, a healthy 70% also said they were cautiously confident for the year; 12% even said they were very confident, with not a single respondent saying they were not at all confident.

Brexit

Meanwhile, amidst the Christmas period and Lockdown 3:0, Brexit has come and gone with little fuss.

There have been some delays at ports, but these appear to be the result of staff shortages due to Covid as much as anything else. As such, pinpointing the fall-out that is a direct result of Brexit has been impossible.

Peter and Gary both said they had not seen any impact as yet, while Ian said that he doesn’t predict any major disruptions to supply. He explained that if OEMs fail to get their parts to the UK – described as ‘Treasure Island’ by car manufacturers, he said – then the aftermarket would fill the void.

‘The OEMs won’t want to give up their market share,’ Ian said. ‘They won’t want to lose their penetration in the UK.’

ARC360, in association with I Love Claims, is supported by corporate partners BASF, BMS, Copart, EMACS, Entegral, Enterprise Rent-a-Car, Mirka, Nationwide Vehicle Recovery Assistance, S&G Response, Sherwin Williams and CAPS; partners asTech, The Green Parts Specialists, Indasa, Innovation Group and Prasco; and strategic partners AutoRaise; NBRA; RepairTalks; and TrendTracker.