Tesla has proclaimed that a future with zero accidents is not a stretch of the imagination, and that its engineers are already working towards achieving it.

Speaking to delegates during a ‘Future of Motor Claims’ panel debate at the inaugural Motor Claims Showcase event, delivered by ARC360 and ILC at the CBS Arena, Coventry in June, Craig Plant, Business Operations Manager, EMEA Body Repair, Tesla said the end-goal is to reach a point where there are no more accidents on the road, no injuries and no deaths.

He said, “A lot of people can’t yet envisage this, but the technology is there. Cars are already making good decisions on their own and helping drivers all the time. At Tesla we have a goal of zero accidents. We think it’s a noble goal but it’s fascinating how legacy automotives and others only critique it and look for attack vectors to say full self-driving is flawed and shouldn’t be pursued.”

Craig was joined on the stage by Neil Bayton, Head of Partnerships, UK, Trustpilot; Gill Nowell, Head of Electric Vehicles, ElectriX powered by LV= General Insurance; Natalie Spurrier, Technical Claims Director, The AA; and Dave Sargeant, Managing Director, Gemini Accident Repair Centres.

Consumers

While not all agreed with Craig’s zero-collision prediction – Dave said there would always be accidents and Natalie wondered how cars can be expected, when impact is unavoidable, to make an ethical choice between a pedestrian on the road or on the pavement – there was widespread consensus that much of what is happening in motor claims now and will happen in the future will be consumer-driven.

They said that customer willingness to embrace new technology – not the technology itself – will shape the future of claims.

Natalie said, “Our challenge is to deliver more for less, and technology is the enabler for that. But there has to be an ease of service. We’re bombarded with technological solutions and we’re having to wade through them to find out which ones might actually add value.”

Craig agreed, warning against introducing technology into claims simply because it’s there.

He said, “We actively embrace technology, but we’re also involved in body repair and we have put a lot of technological solutions in place such as contactless drop off and collections and pin-to-drive, but what we’ve found is that actually the consumer still wants to meet us. It’s important to remember that.

“We’re in a rapid march to put more technology into things, but people still want those human interactions and we need to be wary of technology fatigue among customers. If they have 16 different apps they need to access through the course of an insurance claim, there will be people who can’t cope with that.”

Sustainability

Something else being shaped by the consumer is sustainability. The green agenda was the number one concern during the pandemic – although it has now been overtaken by cost-of-living – and Natalie said that a company’s Environmental, Social and Governance (ESG) focus had to be sharper than ever going forward.

She said, “Consumer behaviour and how they pick the products they use is changing. A PwC report in 2020 found that 83% of consumers think companies need to be actively shaping ESG best practice, and that’s only going to get higher. We’re in a decisive decade and sustainability is going to become even more important. By not making it a strategic focus risks insurers becoming the next Kodak.”

She said that achieving net zero within your own organisation has to be the objective, but that companies must also seek to broaden that out to their supply chains.

Natralie said, “What gets measured gets done. With the UK being the first country to mandate the Task Force on Climate Related Financial Disclosure into legislation, it is now a definable risk for insurers not to make our promises to climate change a strategic priority.”

Electrification

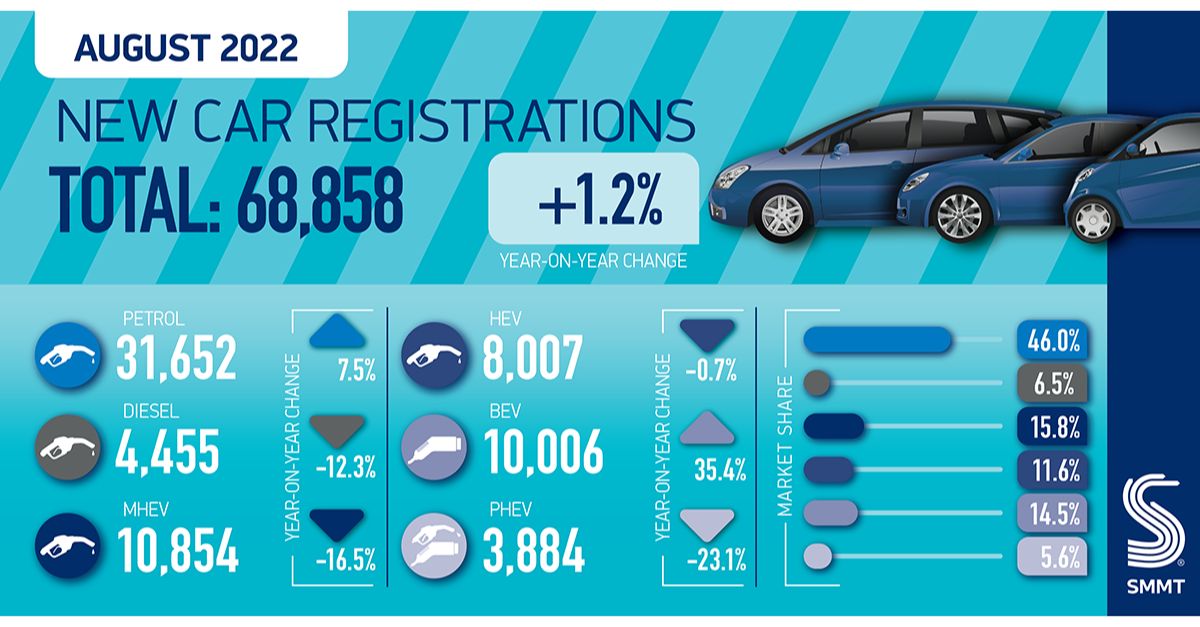

A key aspect of the fight to lower emissions is the surge in electric vehicles. A slow burn for years, their momentum has accelerated at breakneck speed in the last two years and the 2030 ban on the sale of all new petrol and diesel vehicles means that EVs will continue to make up more and more of the car parc.

Again, the technology has been there for a while; it is only customer attitudes that have changed.

Gill said, “Electric growth is consumer-driven, and the demand is absolutely there. There is a bottleneck in supply at the moment, but once that’s released I can see our roads flooded with EVs.”

She explained how LV=, as part of its Green Hearts Standard, is encouraging their usage by making them available as courtesy cars, adding that despite the Society of Motor Manufacturers and Traders predicting that 22,000 jobs will be lost as a result of transition to EVs, she believes the technology presents a big opportunity in job creation.

Articulating the growth potential on the shopfloor, she revealed that just five per cent of technicians are EV trained, and said that similar opportunities exist across the EV supply chain.

“The UK will need 10 EV battery gigafactories to support demand so there is great opportunity there around new skills and new jobs. We’ll also need more charge point manufacturers and installers. We have 32,000 public charge points and that’s going to increase 10-fold by 2030 – not to mention the need for home charge points.”

Skills

However, is this an opportunity or another challenge? If only five per cent of technicians are EV trained and there is already a crippling skills shortage, how will the gaps be filled?

Gemini has recently celebrated its first cohort of apprentices reaching their end-point assessments, and a continuous pipeline of new talent has now been established within the group. However, Dave does not believe the long-established job roles will be fit for purpose in the future.

He said, “The bodywork has stayed the same forever and we’ll still need to be able to repair it, but the technology in cars is massively advanced now and technicians will need to understand it to do their jobs safely.

“Traditionally the skillset on the shopfloor has been in three parts – MET, panel and paint – but the multi-skilled role is more relevant than ever now as it gives you a much better overview of the whole repair. In the future, maybe the job titles won’t change, but the job roles will.”

Future

Of course, the future is a foreign country just as much as the past is and understanding where the sector is going is not easy. But the insurance industry appears to be discovering a new level or responsiveness when it comes to customer demand.

TrustPilot, which measures consumer trends through millions of visits and reviews posted to its platform every month, has found that customer satisfaction had risen seven per cent since it started analysing reviews in 2018 – with improvements noted in communication, staff and customer service, although there is still ground to make up around the claims journey and the courtesy cars.

Neil said, “Consumers want to know what’s happening now, not six months ago, so the more interactive we can get the better. That means including images and videos on our site, and hopefully in the future we’ll also reach a stage where customers can purchase the product via the review.”

The Motor Claims Showcase event was headline sponsored by Enterprise Rent-A-Car, along with fellow sponsors EDAM Group, Control Expert and Procurato.

ILC would like to thank its motor Corporate Partners: AkzoNobel; Audatex; Autoglass; CAPS; Carpenters Group; Copart; Davies Group; e2e; Entegral; Enterprise Rent-A-Car; Gemini ARC; GT Motive; The Green Parts Specialists; IAA; Innovation Group; S&G Response; Sherwin Williams; and thingco.

ARC360 would like to thank its Corporate Partners: Audatex; BASF; BMS; CAPS; Copart; EMACS; Entegral; Enterprise Rent-A-Car; Innovation Group; Mirka; NWVA; S&G Response; and Sherwin Williams, as well as Partners asTech; The Green Parts Specialists; Indasa; and Prasco UK.